The stock market’s outstanding performance over the past year has been driven by tech, specifically the cohort dubbed the Magnificent Seven stocks. So, it’s no surprise that the Street was eager to see how the world’s most valuable companies are doing in their latest earnings reports, as it could provide some insight regarding the viability of an extended rally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While not all those reporting delivered out-and-out stellar readouts, bearing in mind the markets stepped on the gas in Friday’s session, the general answer must be that Wall Street evidently thinks the rally has legs.

The analysts at Morgan Stanley certainly think Big Tech is primed for further gains. The post-earnings analysis by the banking giant’s stock experts shows that they are retaining faith in several of last week’s headline grabbers, and they are telling investors to keep loading on three mega caps – Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Meta (NASDAQ:META).

So, let’s take a closer look at the three and with help from the TipRanks database, we can also see whether the rest of the Street thinks the good times are set to continue for these Magnificent Seven names.

Apple

We’ve grown accustomed to calling Apple the most valuable company in the world, but that has not been the case recently. That position is now occupied by Microsoft after Apple’s long-standing rival took the AI opportunity by the horns, something Apple has not yet conclusively done.

It would be hard to say Apple has been underperforming over the past year – the stock’s gains still exceed those of the S&P 500 – but it has fallen behind some of its tech peers with cracks appearing in the growth story. These have come amidst concerns that demand for its flagship product, the iPhone, is not as strong as it once was. At the same time, investors are wondering where the next leg of growth will come from.

That question was front-and-center last week when Apple delivered its first fiscal quarter earnings (December quarter). While the report featured a return to top-line growth after four consecutive declines, concerns about its standing in China and a soft outlook drove the narrative.

Revenue in the quarter reached $119.6 billion, representing a 2.1% year-over-year increase and beating the consensus estimate by $1.34 billion. At the other end of the scale, EPS of $2.18 came in $0.07 ahead of the forecast. Apple attributed the strong performance to growth in its Services business, while the iPhone results were better than expected. However, the Street was not impressed by the fact that China’s revenue dropped by 13%, with Apple appearing to lose smartphone market share. Additionally, for the March quarter, the company’s guidance called for sales of about $90 billion, a 5% drop compared to the same period a year ago, thereby disappointing Wall Street.

Post-earnings sentiment might be rather low, but that has not altered the bull thesis, says Morgan Stanley analyst Eric Woodring.

“In our view,” said the analyst, “bears will continue to argue that fundamentals do not support Apple’s current valuation. But sentiment is already negatively skewed, and without a catalyst for derating – Apple’s revenue has declined in 4 of the last 5 quarters yet its P/E is up 2-3x turns over this time, so negative earnings revisions haven’t had the intended impact bears expected – we’re not sure what ‘breaks’ the story.”

“Instead, we see [the] guide down as a clearing event (as we previewed),” Woodring went on to add. “Meaning, Apple has now gotten its ‘guide down’ out of the way, and investors can now look to the June Worldwide Developer Conference, where we expect Apple to introduce its first Gen AI-enabled software upgrade, and the September iPhone 16 launch, as upside catalysts to help reaccelerate growth in FY25, where our revenue and EPS are 1-4% above consensus.”

These comments underpin Woodring’s Overweight (i.e., Buy) rating while his $220 price target suggests the shares will climb 18% higher over the coming months. (To watch Woodring’s track record, click here)

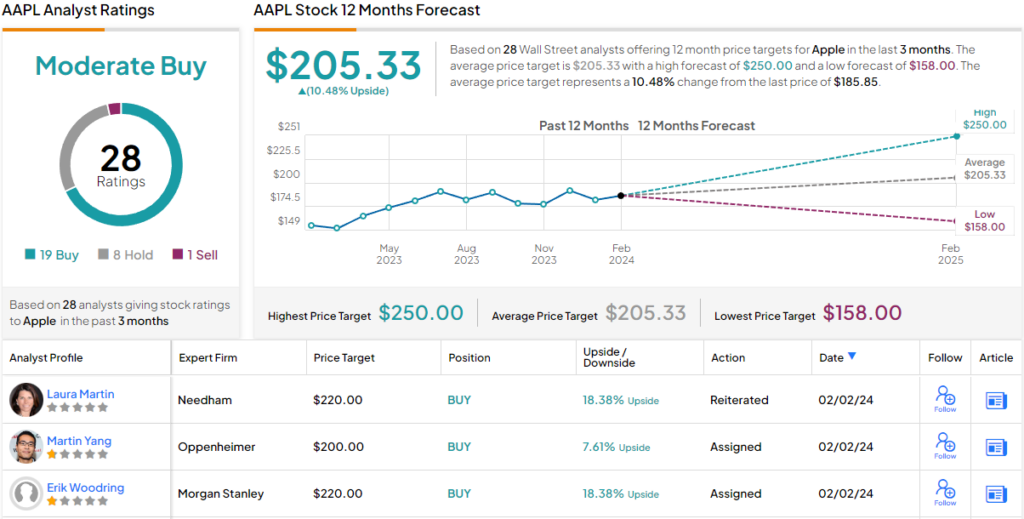

Most analysts agree with Woodring’s stance although not all are on board. Based on a mix of 19 Buys, 8 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. Going by the $205.33 average target, the stock will add 10.5% over the one-year timeframe. (See Apple stock forecast)

Amazon

While investors were not impressed with Apple’s latest print, the same cannot be said for one of its Big Tech brethren. Amazon shares rallied by 8% to reach a 2-year high in the post-earnings session as the e-commerce giant impressed on all fronts in its Q4 report.

Amazon might have been seen as a laggard in the AI game so far, but it seemed to put that argument to bed in the latest report. On the back of seven consecutive quarters of flat sales, growth at AWS was back on the menu as the benefits of AI-focused initiatives started to become evident. All told, AWS revenue climbed by 13% year-over-year (excluding FX) to $24.2 billion in Q4.

That was far from the only positive metric. North American revenue also rose by 13% year-over-year to $105.5 billion, outpacing consensus at $102.9 billion. At the same time, international revenue saw a 17% uptick to $40.2 billion, also trumping the Street’s $39 billion forecast. In total, revenue reached $170.0 billion for a 13.9% year-over-year improvement while beating the analysts’ call for $166.3 billion.

The results at the other end of the equation were also impressive, with operating income hitting $13.2 billion vs. the Street’s expectation of $10.49 billion and above the guided range of $7 to $11 billion. Not to mention, it completely obliterated last year’s result of $2.7 billion.

And while the Q1 top-line revenue guidance between $138 billion and $143.5 billion came in a touch light at the midpoint vs. the Street’s forecast of $142 billion, there was too much good stuff on offer for that to sour proceedings.

The upbeat response from investors is reflected in the assessment of Morgan Stanley analyst Brian Nowak, who stated: “AMZN’s results and guide speak to how improving execution, cost discipline, and an AWS recovery are leading to outsized EBIT and free cash flow revisions… $24.2bn of AWS revenue came in 1% better than us (rising 13% Y/Y), with the 4Q $155.7bn backlog up 17% ($22.7bn) Q/Q. This should provide incremental confidence about forward growth. The impact of cost optimizations continues to diminish, and the pace of new deals, initiatives, and existing migrations to the cloud is accelerating. We expect these trends and growing Generative AI offerings to lead to a continued acceleration in ’24.”

Conveying his confidence, Nowak rates Amazon shares an Overweight (i.e. Buy), while raising his price target from $185 to $200, making room for one-year returns of ~16% from current levels. (To watch Nowak’s track record, click here)

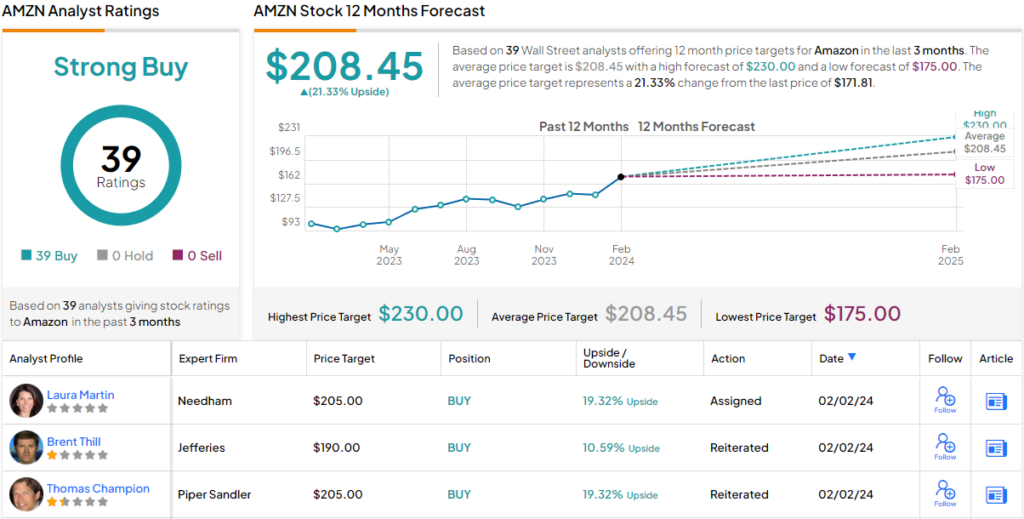

None of Nowak’s colleagues appear to have an issue with that take. Based on Buys only – 39, in total – the stock claims a Strong Buy consensus rating. At $208.45, the average target implies share appreciation of 21% over the coming year. (See Amazon stock forecast)

Meta

Ok, so both Apple and Amazon reported on Thursday with diverging fortunes, but the headlines were reserved for the other Magnificent Seven name, which released its latest quarterly results at the same time.

Subsequently, META shares surged by 20%, adding a huge $197 billion to its market cap in a single day. The big move represents the most significant one-day gain in stock market history, surpassing the prior record set by Apple and Amazon in 2022. It also placed Meta’s market cap at $1.22 trillion.

Based on such a surge, you would expect the social media giant to be firing on all cylinders, and that indeed was the case in Q4. The top-line showed $40.11 billion, amounting to a 24.7% increase vs. the same period last year and beating the Street’s forecast by $940 million. The bulk of the revenue was generated by advertising, which reached $38.7 billion, outpacing the analysts’ expectations of $37.8 billion. The company also reported daily active users (DAUs) of 2.11 billion, above the 2.08 billion expected on Wall Street. There was a beat on the bottom-line too, as EPS of $5.33 exceeded the $4.96 consensus estimate.

The outlook was strong as well. In Q1, Meta anticipates revenue between $34.5 billion and $37 billion. The Street was only looking for $33.87 billion. Even better, Meta initiated a dividend for the first time in its history and increased its stock buyback program by $50 billion.

The report drew plaudits from plenty of Street experts, amongst them Morgan Stanley’s Brian Nowak. In fact, the analyst thinks there’s room for further growth from here.

“We remain bullish META given its strong engagement growth (driven in part by Reels) and lower but rising monetization rate of Reels,” Nowak said. “We estimate that Reels is still monetizing at 37% the rate of core… with runway to close that gap over the next 2 years now set to drive ~60%/~70% of the revenue growth in ’24/’25. Beyond Reels, META is also focused on click-to-message and Shops ads (now $2bn annual run rate) to help create engaging platform experiences… and for advertisers, META is investing in AI-powered tools to drive performance including the Advantage+ product suite, more options for automation, features in Conversions API and more measurement/reporting capabilities.”

Quantifying his stance, Nowak rates Meta shares an Overweight (i.e., Buy), while boosting his price target from $375 to $550. The implication for investors? Upside of 16% from current levels.

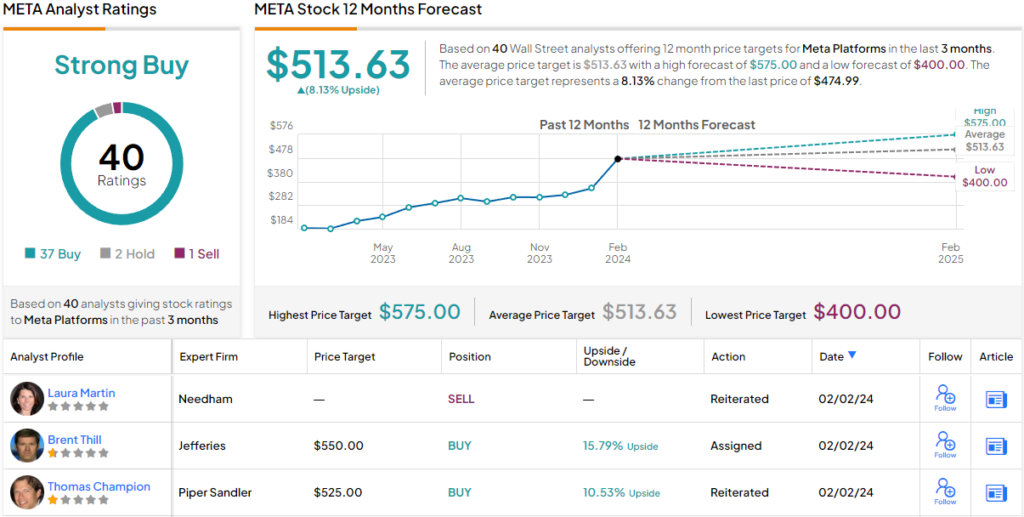

Most on the Street concur; the analyst consensus rates the stock a Strong Buy, based on 37 Buys, 2 Holds and 1 Sell. The forecast calls for 12-month returns of 8%, considering the average target clocks in at $513.63. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.