Shares of Aon (NYSE:AON) fell more than 2% on Friday after the company reported mixed results for the first quarter of 2023. Furthermore, Aon anticipates that negative foreign currency translation and pension costs will have an impact on its future performance.

Aon is a UK-based multinational company that provides various financial solutions like reinsurance, retirement, commercial risk, and health.

The company’s revenue increased by 5% to $3.9 billion, which included 7% organic revenue growth and surpassed the analysts’ forecast of $3.84 billion. Among all its segments, Aon’s Reinsurance Solutions experienced the highest growth overall, up 10%, followed by Health Solutions and Commercial Risk Solutions.

Meanwhile, Aon reported Q1 adjusted earnings of $5.17, which increased 7% from $4.83 in last year’s quarter. The figure came below analysts’ forecasts of $5.31.

In terms of other metrics, the company reported cash and cash equivalents as of March 31 of $1.12 billion, up from $690 million at the end of 2022. Further, free cash flows declined 17% year over year to $367 million.

Outlook

Regarding the future, the company anticipates that currency translation will have a $0.04 per share impact on second-quarter earnings and a $0.14 per share impact on full-year 2023 earnings. Aon also expects net periodic pension costs to have a negative impact of $0.05 per share over the course of the following three quarters.

Additionally, it anticipates double-digit free cash flow growth and mid-single-digit revenue growth for the full year 2023.

Is Aon Stock a Buy?

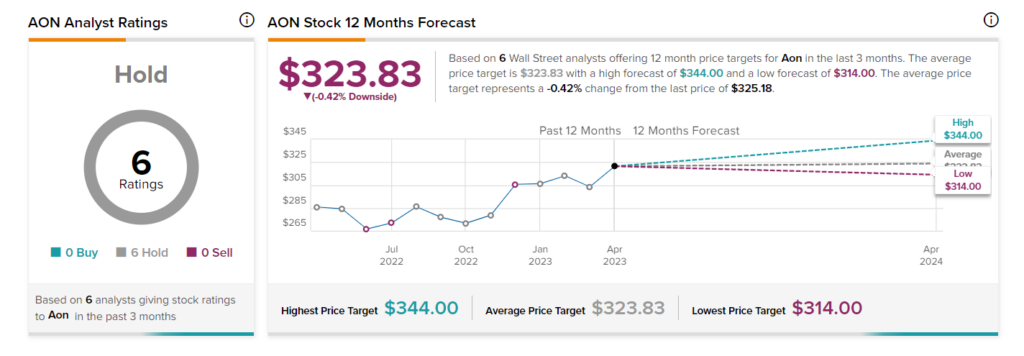

According to analysts, AON stock has a Hold rating on TipRanks based on eight recommendations. The average price target of $323.8 implies 0.42% downside potential from current levels. Shares have gained about 9% so far in 2023.