Accounting and consulting firm Deloitte made a major move by partnering with AI company Anthropic to bring its AI assistant, Claude, to more than 470,000 employees around the world. Indeed, this will be Anthropic’s biggest business rollout so far, and it expands on a relationship that the two companies started last year. Interestingly, Deloitte is one of over 300,000 businesses that have adopted Anthropic’s technology since the company was founded four years ago.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Paul Smith, Anthropic’s Chief Commercial Officer, told CNBC that both companies are investing heavily in the partnership, although they didn’t reveal how much the deal is worth. Over the next few months, Deloitte will begin introducing different versions of Claude that will be customized for various types of employees, such as software developers and accountants.

The Claude rollout will reach Deloitte teams in over 150 countries and comes as Anthropic works to grow its global presence. In fact, back in September, the startup said it would triple its international workforce and hired Chris Ciauri to lead this expansion. That same month, Anthropic released its newest model, Claude Sonnet 4.5, and completed a massive $13 billion funding round that brought its valuation to $183 billion. With Amazon (AMZN) backing it, Anthropic has so far been able to keep up with other AI leaders like OpenAI and Google (GOOGL).

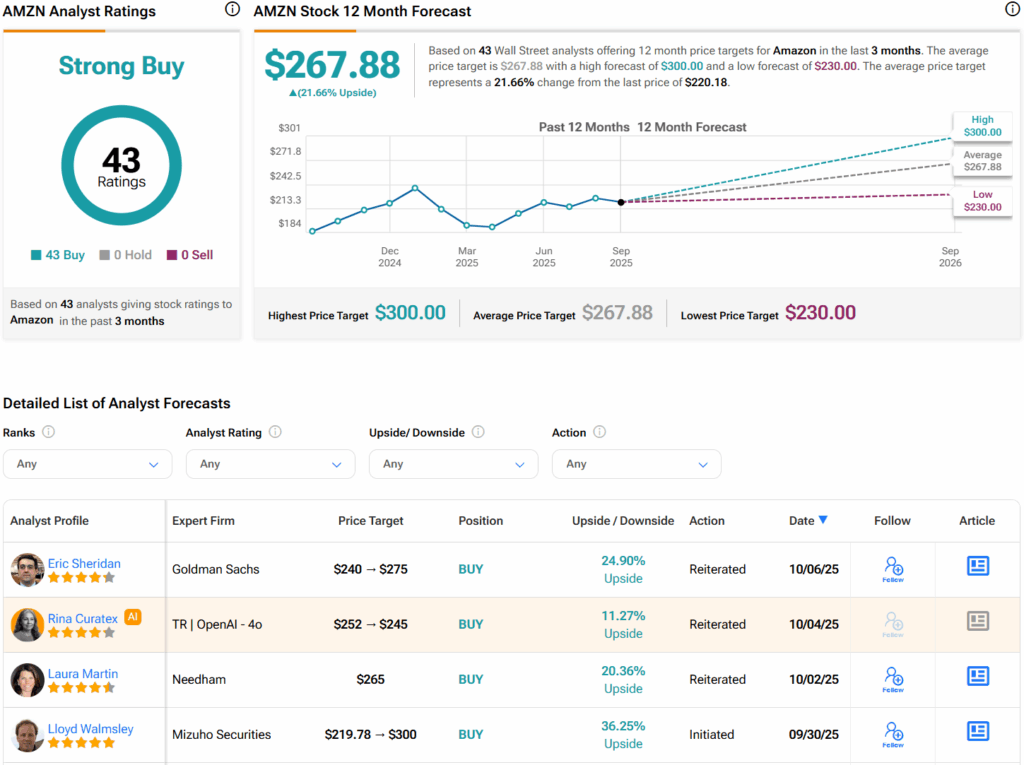

What Is the Price Target for AMZN Stock?

Turning to Wall Street, analysts have a Strong Buy consensus rating on Amazon stock based on 43 Buys assigned in the past three months. Furthermore, the average AMZN stock price target of $267.88 per share implies 21.7% upside potential from current levels.