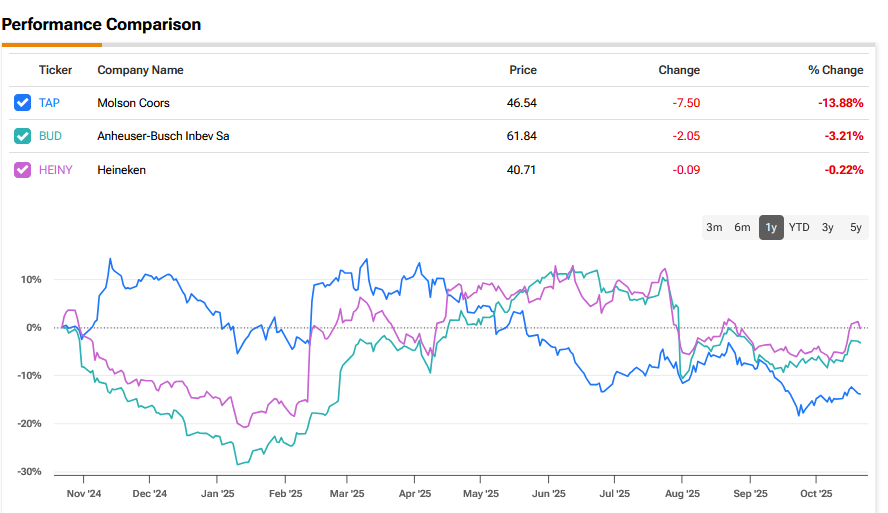

Brewing companies continued to stagger lower today as Holland’s Heineken (HEINY) added to the sector’s woes with warnings over slumping beer demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales Droop

The Dutch brewer today reported a steep drop in beer sales during the third quarter, notably in the Americas and Europe, as cautious consumers kept their cash in their pockets rather than put it behind the bar.

The Amsterdam-based firm, the world’s second-largest brewer after AB InBev (BUD), said full-year operating profit growth would be between 4% and 8%, but warned that it would be “towards the lower end” of that guidance.

“Macroeconomic volatility persisted as anticipated and became more pronounced in the third quarter, creating a challenging environment, resulting in a mixed performance. We expect consumer confidence and demand to recover when conditions normalise,” said Heineken chief executive officer Dolf van den Brink.

Heineken said it sold 59.0 million hectolitres of beer worldwide in the third quarter. This was down on the 62.3 million sold in the second quarter, and also lower than the 61.9 million in the third quarter of last year. Analysts surveyed by the company had expected total global beer volumes of 59.2 million hectolitres.

Global Thirsts

It did see some reason to cheer, however, with ‘solid’ beer demand in Southern Africa, Vietnam and China.

“We anticipate ongoing macroeconomic volatility that may impact our consumers, including weak sentiment, global inflationary pressures, and currency devaluations in relation to a stronger euro,” said the firm. “Given the challenging quarter just behind us, and based on our current assessment of short-term consumer demand, we expect volume to decline modestly for the year 2025.”

It came only a day after rival Molson Coors Beverage Company (TAP) said it is cutting 400 jobs in the Americas, including in Canada, by December of this year as part of a corporate restructuring plan.

TAP has also suffered this year as a result of President Trump’s tariffs policy which has disrupted the cross-border alcohol trade and prompted Quebec to ban American imports.

Other headaches for brewers include rising health concerns about beer, younger people looking at alternative ways to spend their time rather than lying horizontally in pubs, the growth of weight-loss drugs and non-alcoholic beer alternatives.

All of these factors have taken their toll on the sector share prices this year. How many of these are short or long-term hiccups, only time will tell.

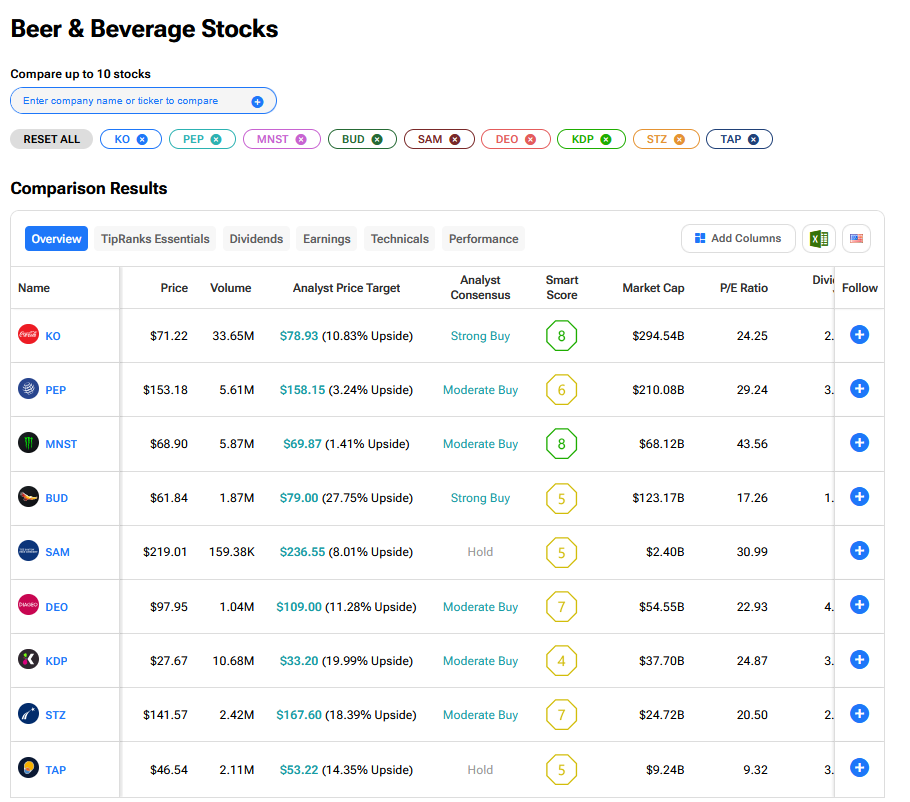

What are the Best Beer and Beverage Stocks to Buy Now?

We have rounded up the best beer and beverage stocks to buy now using our TipRanks comparison tool.