Annaly Capital Management authorized a new share buyback program for the repurchase $1.5 billion of its outstanding shares through December 31, 2021. Shares of the mortgage real estate investment trust edged 1.1% higher at the close on Thursday.

Annaly (NLY) said that that the new repurchase plan will replace the company’s existing $1.5 billion share repurchase program, which had expired on December 31, 2020.

Earlier, On Dec. 11, 2020, the company announced a cash dividend of $0.22 per share, which will be payable on Jan. 29 to common shareholders of record on Dec. 31, 2020. (See NLY stock analysis on TipRanks)

Its annual dividend of $0.88 per share, translates into a dividend yield of 10.41%.

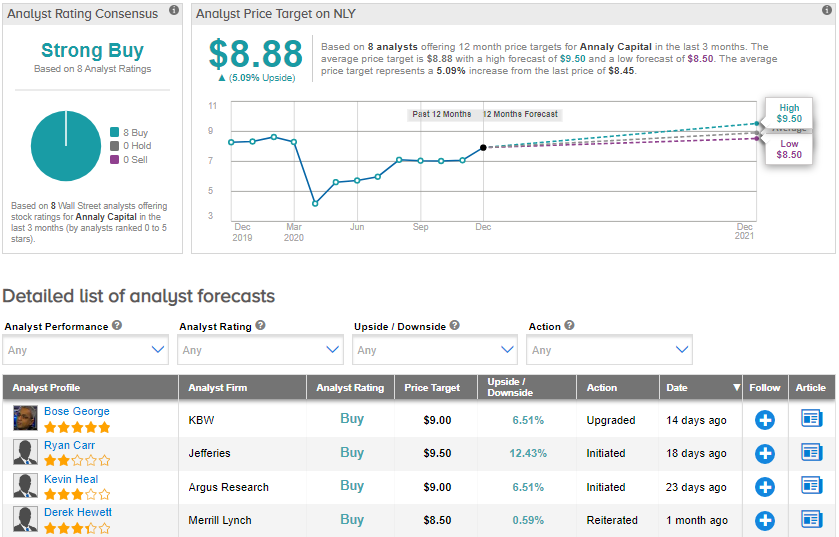

On Dec. 18, KBW analyst Bose George upgraded the stock to Buy from Hold citing its valuation. George maintained a price target of $9 (6.5% upside potential).

In a note to its investors, the analyst said that in 2021, the mortgage banking sector will continue to operate at more moderate levels than 2020, given a “fairly stable” interest rate environment and improving economy.

Like George, the rest of the Street also has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 8 unanimous Buys. Meanwhile, the average analyst price target stands at $8.88, and implies 5.1% upside potential at current levels. Shares were down 10.3% in 2020.

Related News:

Alibaba Ups Buyback Program to $10B; Street Firmly Bullish

Afya Approves New Share Buyback Plan; Street Sees 27% Upside

Truist Financial To Resume $2B Share Buyback In 1Q; Shares Rise 3%