Alibaba (BABA) stock has risen 32% over the past month and has rallied 110% year-to-date, driven by solid demand for artificial intelligence (AI) infrastructure, increased AI spending, and the recent deal with semiconductor giant Nvidia (NVDA). Several analysts have raised their price targets for the Chinese tech giant’s stock, backed by AI tailwinds in the cloud business. Notably, Morgan Stanley analyst Gary Yu lifted his price target for Alibaba stock to $200 from $165 and reiterated a Buy rating. Likewise, Jefferies analyst Thomas Chong boosted his price target for BABA stock to $230 from $178 while reaffirming a Buy rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley Analyst Sees Higher Upside Potential in BABA Stock

Yu revised his price target, noting accelerating growth in Alibaba’s cloud division and continued momentum in the company’s core operations. The analyst expects Alibaba’s cloud business to grow by 32% in Fiscal 2026 and 40% in Fiscal 2027, driven by increased capital spending, model upgrades, strategic partnerships, and accelerated international expansion.

The analyst’s improved outlook for AliCloud follows the company’s recently held Apsara Conference. He also noted other key developments, including the launch of the flagship AI model Qwen3-Max, a partnership with Nvidia on physical AI, and the rollout of data centers in Brazil, France, and the Netherlands.

Beyond the cloud business, Yu expects continued momentum in Alibaba’s core business. He expects customer management revenue (CMR) growth to sustain at 10% in Q2 FY26 and the full year FY26, bolstered by improvement in take rates and increasing contributions from Quick Commerce (QC).

Jefferies Is Confident About Alibaba’s Growth Potential

Jefferies’ Chong raised his price target for BABA stock to reflect his bullish outlook for cloud and synergies with Quick Commerce in China. The 5-star analyst has turned more positive about Alibaba’s cloud business following the Apsara Conference, with impressive progress made in multiple areas. Chong believes that Alibaba’s Qwen3-Max is a global top-tier model in terms of modeling capabilities. He also highlighted Alibaba’s positioning as a full-stack AI service provider.

Chong also pointed out the synergies generated from Alibaba’s Quick Commerce platform, as reflected in the growth of the Taobao mobile app’s monthly and daily active users, and the incremental benefits to CMR due to a rise in QC’s traffic, users, and purchase frequency.

Is BABA a Good Stock to Buy Now?

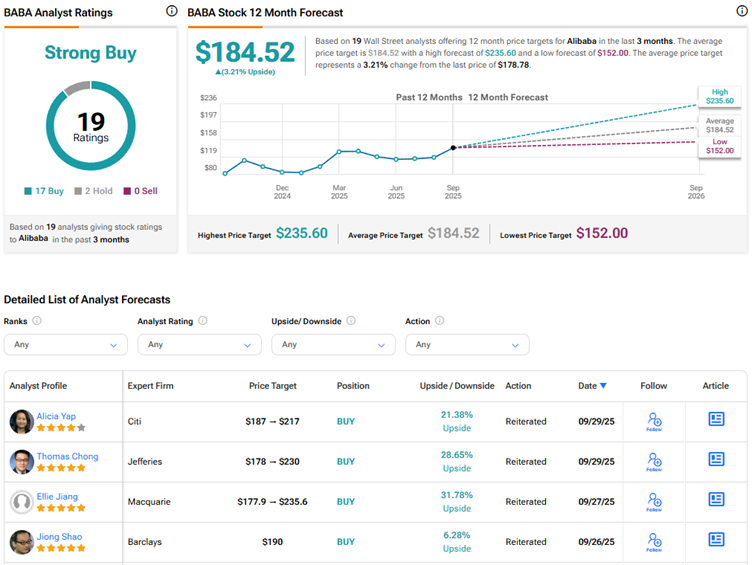

With 17 Buys and two Holds, Wall Street has a Strong Buy consensus rating on Alibaba stock. The average BABA stock price target of $184.52 indicates 3.2% upside potential.