Alibaba Group (BABA) shares rose 8.19% on Wednesday after the company said it will increase its artificial intelligence budget beyond its earlier $53 billion plan. The update came at the Apsara Conference, where Chief Executive Officer Eddie Wu noted that global investment in the sector could reach $4 trillion over the next five years. He stressed that Alibaba must keep pace with its peers as demand for advanced infrastructure continues to expand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Qwen3-Max and Strategic Alliances

Alongside the spending news, Alibaba introduced a new large language model called Qwen3-Max. With more than one trillion parameters, the company said it delivers stronger performance in coding and autonomous agent tasks than rivals. Alibaba also announced its first data centers in Brazil, France, and the Netherlands. These additions mark an effort to extend its cloud reach beyond China while moving closer to international clients.

In addition, Alibaba Cloud revealed a partnership with Nvidia (NVDA). According to Bloomberg, the deal will bring Nvidia’s Physical AI software stack to Alibaba’s platform, helping developers build models for robotics, autonomous vehicles, and smart environments. The collaboration stands out, given the current trade limits between the U.S. and China; yet, both companies are advancing as demand for AI tools fuels new alliances.

Ark Returns and Marvell’s Buyback

Investor sentiment was further lifted when Cathie Wood’s Ark Investment Management reopened a position in Alibaba for the first time since 2021. The move added to signs of renewed institutional interest in the stock.

Meanwhile, Marvell Technology (MRVL) announced a $5 billion stock buyback program along with a $1 billion accelerated purchase. The company said it plans to keep its focus on data center growth while also returning capital to shareholders.

In short, Alibaba’s expanded AI plan and its new partnership with Nvidia underscore its push to secure a larger role in the global AI race. At the same time, the broader market has responded with fresh momentum for companies tied to growth in this area.

Is BABA Stock a buy?

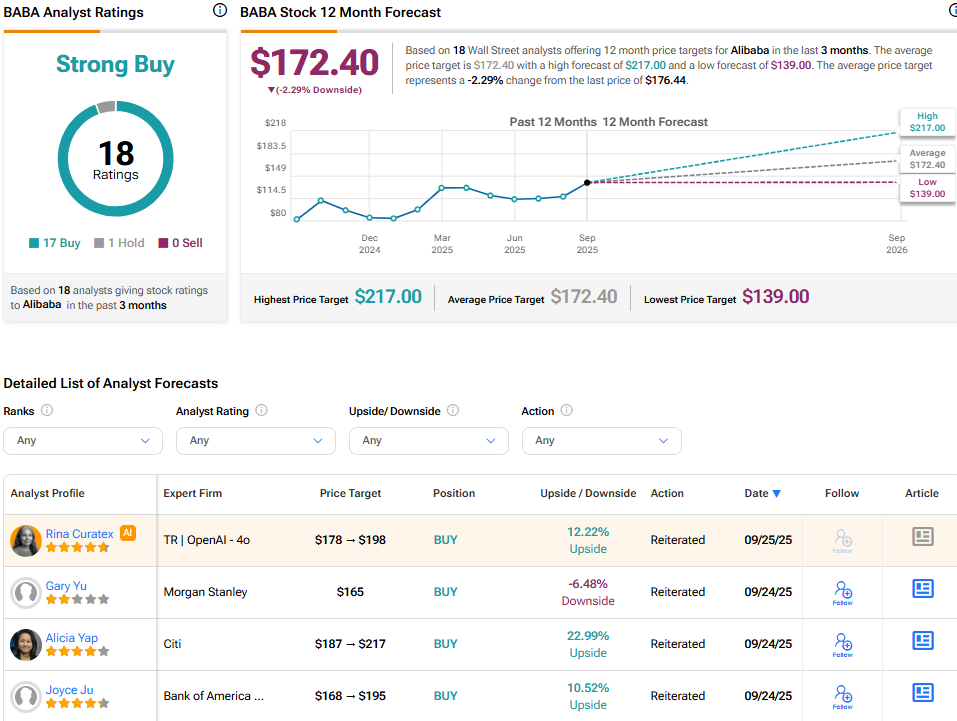

On the Street, Alibaba scores a Strong Buy consensus, based on 18 analysts’ ratings. The average BABA stock price target stands at $172.40, implying a 2.29% downside from the current price.