Following its latest financial results, a number of analysts are raising questions about Tesla’s (TSLA) plans to sell cheaper electric vehicle models.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Leading into its third-quarter print, Tesla introduced newer and cheaper versions of its Model Y and Model 3 electric vehicles. Tesla CEO Elon Musk has said that the company can increase overall sales and earnings by driving volume through cheaper prices, even if each vehicle itself is less profitable.

Accordingly, the Model Y and Model 3 are now priced $5,000 to $5,500 lower than previous versions of the vehicles in the U.S. The cost reductions were achieved by reducing the battery size, offering a less-powerful motor, and removing rear touchscreens and other bells and whistles. However, some analysts are questioning this approach after Tesla’s Q3 profit numbers came up short.

The Future for Tesla

In a note to clients, Futurum Equities wrote: “Tesla’s intent is clear – trade short-term margin for long-term network scale.” The brokerage warned investors to expect some cannibalization of sales of pricier models as consumers opt for the cheaper Model Y and Model 3 electric vehicles.

On Tesla’s latest earnings call, Musk defended the pricing strategy and shift towards cheaper electric vehicles, saying that the company’s future lies in self-driving robotaxis but that Tesla must keep sales up while the new machines are developed and seek regulatory approval.

Still, some investors and analysts are questioning the approach after Tesla reported Q3 earnings per share (EPS) of $0.50, which fell short of the $0.54 expected on Wall Street. Tesla’s profit in the third quarter was down 37% from a year earlier.

Is TSLA Stock a Buy?

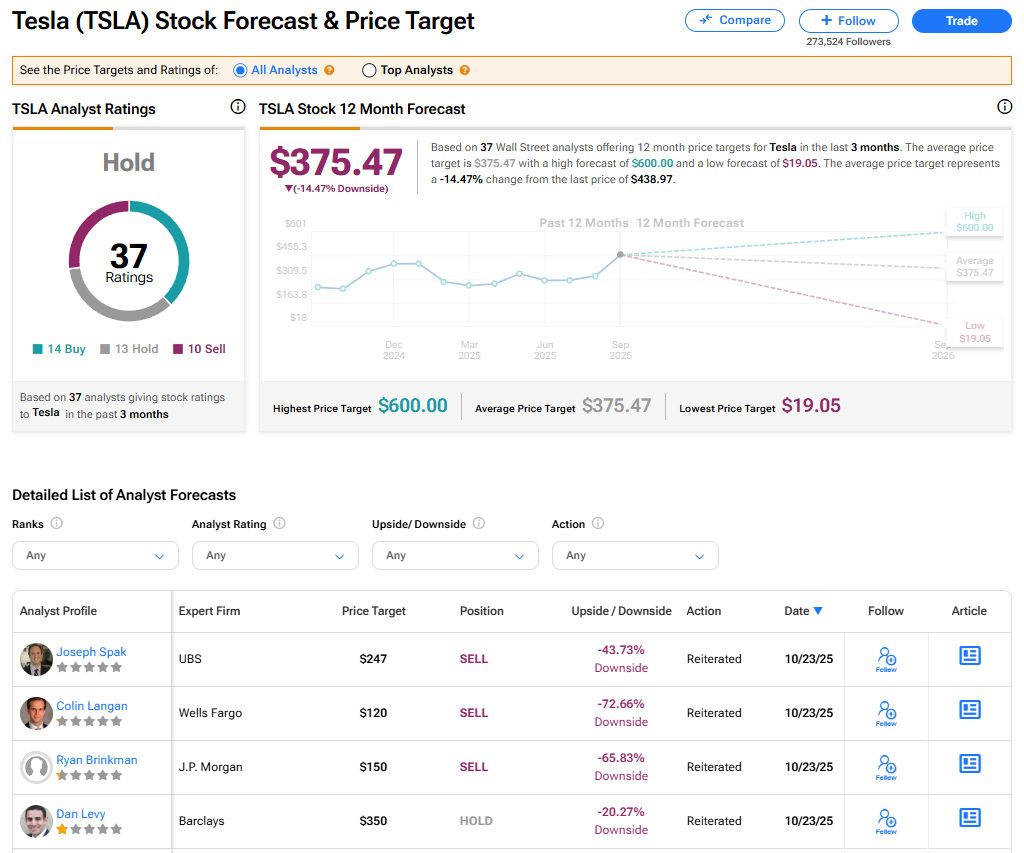

Tesla’s stock has a consensus Hold rating among 37 Wall Street analysts. That rating is based on 14 Buy, 13 Hold, and 10 Sell recommendations issued in the last three months. The average TSLA price target of $375.47 implies 14.47% downside from current levels.