General Motors (GM) delivered a strong third-quarter report that surprised Wall Street and sent its stock soaring more than 15% on Tuesday, marking its best trading day in the past five years. The automaker beat expectations on both revenue and earnings, while also raising its full-year guidance. This drove a wave of bullish analyst reactions and upward price target revisions for GM stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GM Impresses Wall Street

Wedbush analyst Daniel Ives raised his price target to $75 from $65 while maintaining a Buy rating. The Top analyst highlighted GM’s gains in both traditional and electric vehicles, along with a smaller-than-expected hit from tariffs, as reasons for growing confidence in the stock.

TD Cowen’s Itay Michaeli echoed the optimism, calling GM stock his “top pick.” He reiterated a Buy rating and $92 price target. Michaeli highlighted the company’s 24% EBIT beat and a notable 18% increase in 2025 free cash flow guidance, despite industry headwinds and inventory de-stocking.

Similarly, Goldman Sachs’ Mark Delaney maintained a Buy rating and $74 target on GM stock, calling its Q3 report strong across the board. He noted that the company expects 2026 to outperform 2025, citing progress on EV profitability, warranty costs, and regulatory headwinds.

“We expect tariffs (including the impact of the latest US tariff policy announced on 10/17), market conditions, EV profitability, less stringent US emissions rules, and AVs/AI/software to be key topics on the call,” said Delaney.

GM’s Road Ahead

General Motors has entered Q4 with strong momentum. The company is doubling down on its U.S. manufacturing footprint with a $4 billion investment aimed at boosting high-margin SUV and pickup production. This move helped offset nearly 30% of Q2 tariff costs and signals GM’s intent to overhaul its supply chain.

The company continues to scale its EV lineup while working to reduce losses in the segment. Investments in battery joint ventures and cost efficiencies are likely to improve margins in 2026. Further, its core business of internal combustion engine (ICE) vehicles remains robust.

Importantly, GM is also expanding its personalization and cybersecurity offerings, aiming to be a player in providing safe, smart transportation for the future.

Is GM a Good Stock to Buy Now?

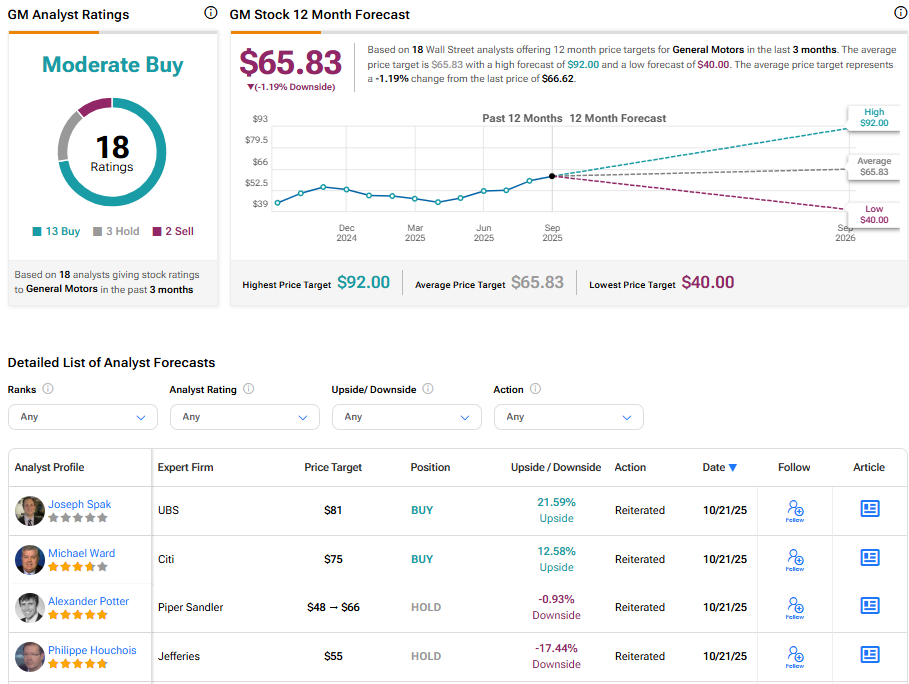

Overall, GM stock has a Moderate Buy consensus rating based on 13 Buy, two Hold, and two Sell recommendations. The average General Motors stock price target is $64, implying a 4.09% upside potential from current levels.