There’s trouble in the air for chip maker Texas Instruments (NASDAQ:TXN). Multiple analysts have emerged with some unsettling perspectives on the stock, and investors are scenting smoke and running for the hills. As a result, TXN shares sank at the time of writing.

The first slice of bad news came from Morgan Stanley by way of Joseph Moore. Moore notes that most of Texas Instruments’ business is “soft” and that gross margins are starting to fall as well. There will likely be some rebound for personal electronics demand, but that’s not likely to be much help for Texas Instruments immediately. Meanwhile, Bank of America analyst Vivek Arya came out with his own slate of issues. Top of that list was the company’s free cash flow margin. With that metric under 17%, it represented the lowest point since 2010. Given what the rest of 2010 looked like, just after the Great Recession of 2008, that’s no mark of confidence.

Texas Instruments also didn’t spark up a lot of confidence with its recent earnings report. While earnings themselves came out reasonably well—Texas Instruments offered beats for both earnings and revenue—its guidance proved a little less inspiring. Texas Instruments projected earnings between $4.36 billion and $4.74 billion. Consensus called for $4.59 billion, which is right around the middle. That leaves a beat just as likely as a miss, and with weak demand fueling the forecast, that’s not an outcome that looks all that appealing to investors.

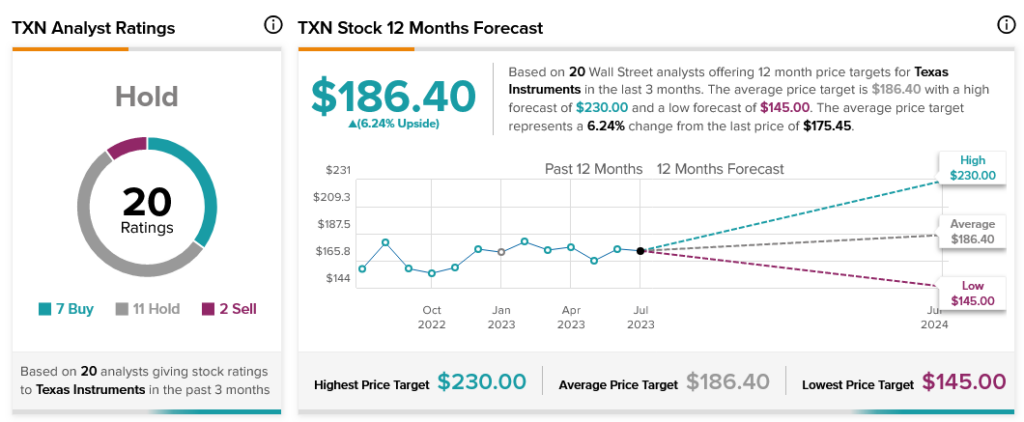

It doesn’t look especially appealing to analysts, either. Currently, Texas Instruments stock is considered a Hold, with seven Buy ratings, 11 Hold, and two Sell in support. Further, with an average price target of $186.40, Texas Instruments stock offers a 6.24% upside potential.