Normally, beverage company PepsiCo (NASDAQ:PEP) is regarded as a recession-proof stock. However, that didn’t seem to be the case today, as it lost fractionally after an analyst expressed concerns about Pepsi’s revenue growth rate. The word came from Argus Research analyst John Staszak, who noted that consumers were looking to spend less on food, thanks to a combination of soaring prices from inflation and growing use of weight-loss drugs that prompted less eating in general.

Consumers were also finding a greater interest in “healthier fare,” which means that sugary drinks and salty snacks like potato chips were slipping. That combination of factors was sufficient for Staszak to lower his rating from Buy to Hold. There is some cause for optimism, like improving supply chain matters and better distribution, but it’s having a tough time kicking in against a consumer market that’s tiring of hiked prices and the product line in general.

Trying to Meet Rising Demand in India

That’s admittedly a hard hand to beat, but PepsiCo may have a new plan to do just that. Its latest move features a new “flavorings factory” being built in India. The new facility will be located in Ujjain, in Madhya Pradesh, which will put together new flavors and help meet rising demand in India. While hoping for Indian demand to take the strain of the loss of the U.S. market might be a forlorn hope, it will likely take at least some of the sting out of it. And certainly, some new flavors might help catch and keep attention, even as customers pivot away from sugary drinks.

Is PepsiCo a Buy, Sell, or Hold?

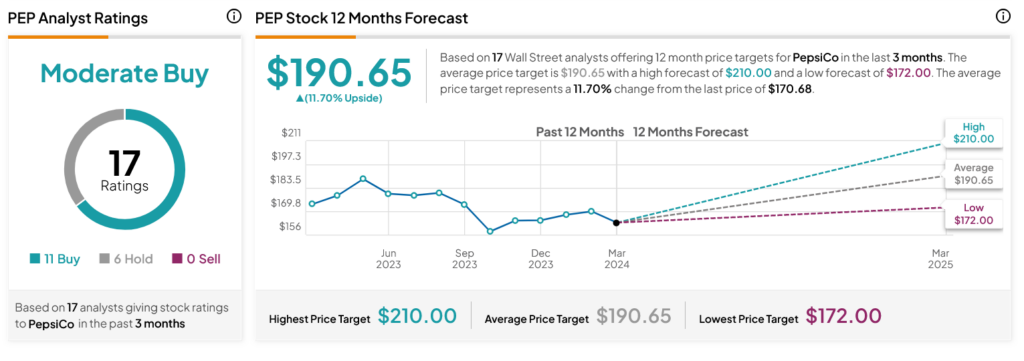

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PEP stock based on 11 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 3.32% loss in its share price over the past year, the average PEP price target of $190.65 per share implies 11.7% upside potential.