Today turned out to be a disaster for biotech stock Kymera Therapeutics (NASDAQ:KYMR), which landed a downgrade at Bank of America. The why behind the drop only made matters worse, and Kymera slid over 9% in the closing minutes of Wednesday afternoon’s trading.

Bank of America cut the rating on Kymera to Neutral, and the biggest reason was that Kymera doesn’t have much in its pipeline. It wasn’t all bad, however, as Bank of America analysts had some praise for Kymera’s recent “de-risking,” along with its “…clear differentiation among targeted protein degradation peers.” But that didn’t stop the main thrust of Bank of America’s argument: that 2024 would be more about “…validation of prior data versus many new data reveals.”

Success, Until Now

By and large, it’s been a good last few months for Kymera. Its recent collaboration with Sanofi (NASDAQ:SNY) delivered $55 million in milestone payments, reports noted, and its share price has been on the rise, up 34% over the last month. However, some are starting to question just how sustainable that price hike is, and that might not bode well for long-term shareholders. Worse, one of Kymera’s protein degraders, known as KT-413, managed to do well in its early-stage testing, but despite this, Kymera is shutting the whole thing down.

That could have been one of those near-term catalysts that Bank of America was looking for, and yet, Kymera didn’t think enough of it to keep it around. Granted, Kymera shut it down to focus resources elsewhere, but those resources haven’t even hit testing yet.

Is Kymera Therapeutics a Buy?

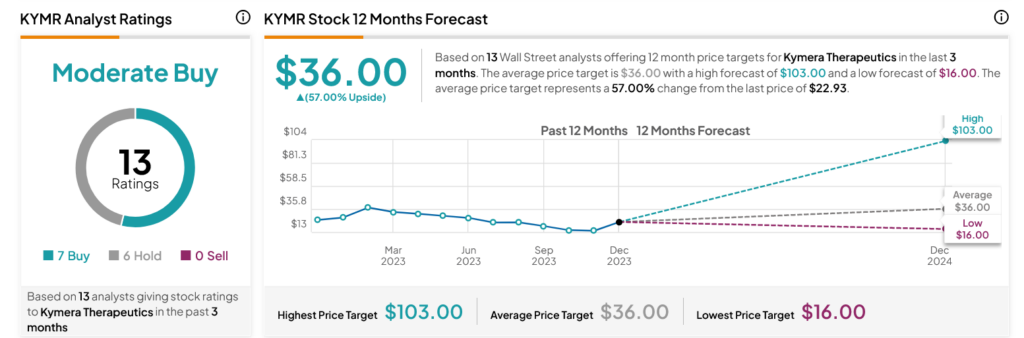

Turning to Wall Street, analysts have a Moderate Buy consensus rating on KYMR stock based on seven Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 10.86% loss in its share price over the past year, the average KYMR price target of $36 per share implies 57% upside potential.