Raytheon Technologies (NYSE:RTX), one of the biggest names in defense stocks and jet engines around, lost ground in Wednesday’s trading as a few different factors showed up to provide headwinds. Not only are analysts reconsidering, but some recent mechanical failures are also hurting the stock.

One of the biggest problems for Raytheon came when Morgan Stanley, when analyst Kristine Liwag cut Raytheon from an “overweight” to an “equal weight.” Liwag noted that Raytheon offered up a slate of “unknown unknowns,” a reference to the classic Donald Rumsfeld doggerel speech about how much you know, and how much you don’t know. One of those unknown unknowns turned out to be related to a high-pressure turbine disc that’s part of a geared-turbofan engine. Said turbine disc came with an unexpected defect, and that defect sent Raytheon shares plummeting.

Perhaps worse for Raytheon is that one of its biggest customers still hasn’t filed a purchase order for new weapons. Raytheon made a substantial quantity of the weapons that were sent to Ukraine in the Russia-Ukraine war. However, Raytheon is still waiting on the replacement orders for the weapons that have already been sent. It’s already received $2 billion in replenishment orders, notes a Defense One report, but it’s looking for $2.5 billion worth of orders still to arrive.

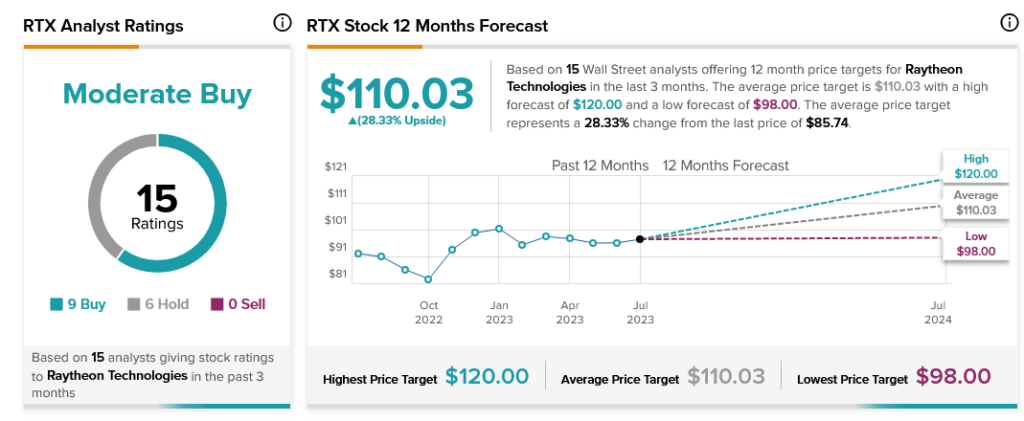

Yet despite the recent troubles, analysts are still largely in Raytheon’s corner. Currently, analyst consensus calls Raytheon stock a Moderate Buy, backed by nine Buy ratings and six Hold. Further, Raytheon stock comes with a 28.33% upside potential thanks to its average price target of $110.03.