The shopping mall used to be one of America’s great institutions. And Simon Property Group (NYSE:SPG) used to be one of the biggest names therein.A changing retail landscape has left the mall vulnerable, and Simon’s recent earnings report proves as much conclusively. Simon lost nearly 5% in Thursday afternoon’s trading, because of its earnings and a recent analyst downgrade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The downgrade in question came from Evercore ISI, who—via analyst Steve Sakwa—lowered Simon from “outperform” to “in line.” Sakwa also lowered his price target from $131 to $129. The reason behind this move involved several factors at once, starting with its recent improvement in share price and moving to its growing complexity. Throw in an earnings report like the one Simon rolled out and things only got worse from there.

Simon’s earnings proved a mixed bag. Its earnings per share figure came in at $2.88, which was just shy of analyst expectations calling for $2.92. Revenue, however fared better, coming in at $1.37 billion against analysts looking for $1.24 billion. That $1.37 billion, meanwhile, was up 7% against last year. Not bad, but the future projections certainly didn’t help as Simon looks for total annual net income per share to be between $6.39 and $6.49. Earlier forecasts looked for $6.45 to $6.60 per share. However, perhaps in a bid to keep shareholders around, Simon hiked its quarterly dividend from $1.85 per share to $1.90.

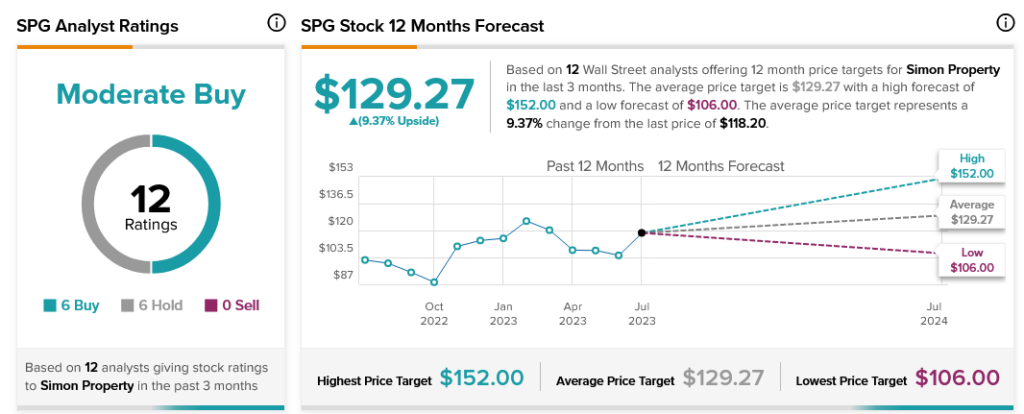

Analysts are cautiously optimistic on Simon’s overall trajectory. Analysts call Simon Property Group stock a Moderate Buy, with six Buy ratings and six Hold ratings. Further, Simon Property Group stock offers investors a 9.37% upside potential on its average price target of $129.27.