Since the banking crisis began, investors have been looking toward the Federal Reserve. The central bank’s move on interest rates had been widely anticipated, and investors were eager for a sign to indicate whether the Fed saw inflation or a bank run crisis as the greater threat.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With central bank’s announcement of a 25 basis point rate hike, or 0.25%, the impression is that the Fed has tried to take a middle path, and is slowing its interest rate policy to calm the banking sector while not abandoning the fight against inflation. The key funds rate is now in the range of 4.75% to 5%; the Fed’s end-of-year target is assumed to be between 5% and 5.25%.

Reflecting on this situation, Goldman Sachs chief US equity strategist David Kostin wrote, “If the economy slows sharply and justifies current rate market pricing, then investors will likely rotate from unprofitable stocks towards perceived ‘quality,’ including firms with high margins and high returns on capital.”

And this will take us to dividend stocks, a perennially popular defensive play when markets turn sour. Goldman Sachs analyst Caitlin Burrows has been pointing out some quality dividend stocks for just that. These are div players offering yields of at least 7%, and according to the analyst, they also offer double-digit upside potential.

Kilroy Realty (KRC)

We’ll start with a REIT, a real estate investment trust, Kilroy Realty. These companies are perennial champs among dividend payers, and Kilroy is a good example of the group. The company has a portfolio of 55 properties, mainly in California, but also in Washington State and Texas. Kilroy’s portfolio focuses on office space, life science properties, retail, and residential developments. As of the end of 2022, Kilroy had nearly $10.8 billion in total assets, including $9.5 billion in real estate assets.

Those real estate assets are primarily the properties in the portfolio, which totaled 16.2 million square feet. At the end of 4Q22, Kilroy’s properties had a 92.9% lease rate, and a 91.6% occupancy rate. These underlaid the company’s sound performance in the last reported quarter, 4Q22, when the total revenue came in at $284.3 million, beating the forecast by $6.17 million. The quarterly funds from operations, FFO, a key metric for REITs, was reported at $1.17 per share, 2 cents better than expected.

For the full year 2022, Kilroy reported revenues in excess of $1 billion, marking the first time the company had achieved that level. FFO for 2022 was reported at $4.68 per diluted share.

Kilroy’s sound results support the company’s dividend payment, which in February was declared for an April 12 payout of 54 cents per common share. At this rate, the dividend annualizes to $2.16 per share and gives an inflation-beating yield of 7.8%.

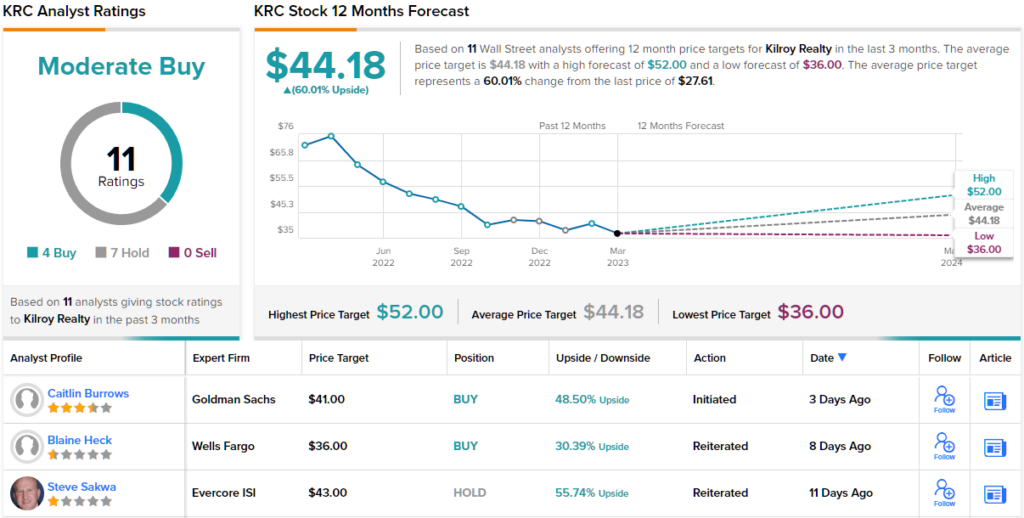

Covering this high-yield dividend stock for Goldman Sachs, analyst Caitlin Burrows sees a bright future, and writes: “We forecast KRC’s average annual FFOPS growth over 2023E-2025E to equal +0.9%, which is +150 bps better than the Office REIT average of -0.6%. In the current environment, within office REITs, we believe KRC’s mix of high quality and relatively new properties, positive mark-to-markets, and lower leverage position the company well for multiple expansion.”

In line with her upbeat stance, Burrows gives KRC shares a Buy rating and a price target of $41 to suggest a potential gain of 48.5% in the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~56% potential total return profile. (To watch Burrows’ track record, click here)

Overall, there are 11 recent analyst reviews on file for Kilroy, and their breakdown of 4 Buys and 7 Holds leads to a Moderate Buy consensus rating for the stock. The shares are trading at $27.61 with a $44.18 average price target, for a 60% upside potential in the coming year. (See KRC stock forecast)

Simon Property Group (SPG)

The next stock Goldman Sachs is betting on is another REIT, Simon Property. This company is mainly a commercial REIT with a portfolio of retail properties skewed heavily toward the shopping mall niche. Simon currently has more than 250 top-end retail properties around the world, including 25 of the top locations in the US for retail. Simon has more than $9 billion invested in development projects, and since 2020, Simon has had an 80% ownership interest in the Taubman Group, another large international retail property owner.

Simon can boast a strong occupancy rate for its properties, of 94.9% as of December 31, 2022. This was up 1.5% year-over-year, and reflected increased retail activity post-COVID.

The company’s revenues, net income, and FFO also showed increases over the past year. In the last quarter, 4Q22, Simon had revenue of $1.4 billion, up 6% y/y and beating the forecast by 8.5%. Net income attributable to stockholders was $673.8 million, or $2.06 per diluted share, for a 34% y/y increase. Quarterly FFO came in at $1.183 billion, up from $1.17 billion in the prior year. The FFO per diluted share, at $3.15, came in ahead of the $3.13 consensus.

For the full year 2022, FFO was reported at $4.45 billion, or $11.87 per diluted share. This represented a 3.8% increase from the $11.44 reported in Q421.

While reported results were strong, Simon’s forward guidance was somewhat disappointing. The projected 2023 FFO, in the range of $11.70 to $11.95, was well below the consensus expectation of $12.13.

Even though guidance was low, Simon still maintained its reliable, high-yield dividend. The next payment, of $1.80 per common share, is scheduled to go out on March 31. At the annualized rate of $7.20 per common share, the yield is 7%; this is a full point above the current annualized rate of inflation.

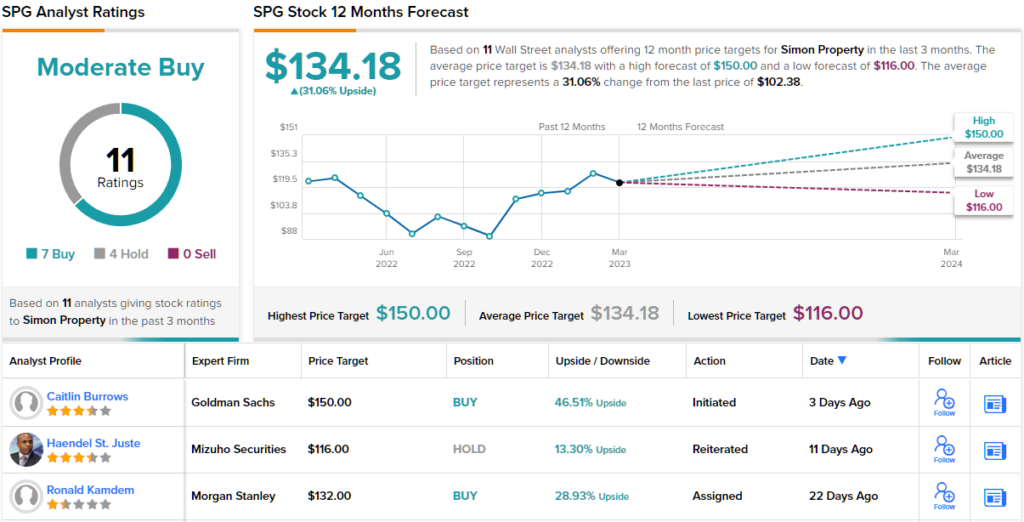

Among the bulls is Goldman Sachs’ Caitlin Burrows, who believes the company’s ‘large, high-quality portfolio’ of assets isn’t fully reflected in the current share price.

“As a result of continued store openings, especially in high quality properties, we expect SPG’s occupancy and rental rates to increase. We believe this strength in fundamentals is not currently appreciated in SPG’s multiple. Further, we believe SPG’s market share of properties (including 94 US malls, 69 US outlets, and an additional roughly 75 properties across Mills, international outlets, and the TRG mall portfolio) and balance sheet allow the company to win an outsized number of leasing deals,” Burrows opined.

In Burrows’ view, steady and reliable growth is worth a Buy rating, and her $150 price target indicates her confidence in a 46.5% share appreciation over the course of this year. (To watch Burrows’ track record, click here)

Overall, SPG has picked up 11 recent analyst reviews, with a breakdown of 7 Buys and 4 Holds for a Moderate Buy consensus rating. The stock is selling for $102.38, and its average price target of $134.18 implies a 31% one-year gain. (See SMG stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.