By 2031, U.S. healthcare spending is projected to surpass $7 trillion, accounting for almost 20% of U.S. GDP. As the demand for more affordable options surges, generic drug makers are poised for significant growth. Biopharmaceutical companies like Amphastar Pharmaceuticals (NASDAQ:AMPH) are well-positioned to ride the wave of this growing market. As can be seen from the chart below, the stock has been trending downwards this year, providing a window of opportunity for savvy, long-term investors.

Proprietary and Biosimilar Products

Amphastar Pharmaceuticals is a biopharmaceutical company that primarily develops, manufactures, and sells complex generic and proprietary injectable, inhalation, and intranasal products. Most of Amphastar’s business is B2B, with over half of its revenues concentrated on four large customers.

The company’s portfolio includes biologics, innovative drug delivery systems, and proprietary platforms, as well as high-margin products treating severe hypoglycemia. In addition to developing generics, Amphastar also emphasizes strategic acquisitions.

The company recently acquired BAQSIMI, the first and only FDA-approved glucagon nasal powder, from Lilly (NYSE:LLY). It is expected to boost Amphastar’s sales growth significantly by adding a well-received branded product to its lineup.

Recent Financial Results

Amphastar’s financial performance in the fourth quarter of 2023 was particularly strong, with revenues of $178.1 million, up almost 32% from Q422. Non-GAAP net income came in at $46.9 million, or $0.88 per share, falling slightly short of consensus expectations of $0.91.

For Fiscal Year 2023, the company’s net revenues amounted to $644.4 million, representing a substantial annual growth of 29%. Non-GAAP net income stood at $175.7 million, or $3.32 per share. This is a significant improvement in the company’s financial performance compared to the previous fiscal year, and represents a third consecutive year of increasing revenue and earnings.

What is the Target Price Forecast for AMPH Stock?

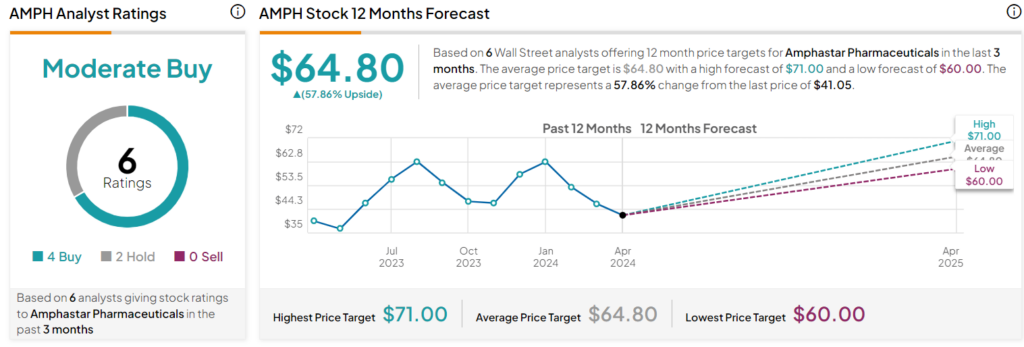

The stock has been trending down this year and has posted a -33.63% return thus far. The shares are trading toward the low end of the 52-week price range of $35.62-$67.66 and continue to show negative price momentum, trading below the 20-day (44.31) and 50-day (47.94) moving averages.

Despite the declines, analysts following the company are cautiously optimistic about the stock. Based on six Wall Street analysts’ recommendations and 12-month price targets published in the past three months, Amphastar is rated a Moderate Buy. The average price target for AMPH stock is $64.80, which represents a 57.86% upside from current levels.

Final Analysis on AMPH

Amphastar Pharmaceuticals has positioned itself to thrive in the growing demand for affordable healthcare options. The company is poised for potential sales growth with a well-diversified portfolio focused on generic and proprietary injectable, inhalation, and intranasal products, while a recent strategic acquisition has bolstered its offerings. The stock’s recent dip into value territory could create a window of opportunity for discerning investors to participate in the company’s growth trajectory.