American Tower’s (NYSE:AMT) FY 2023 results reaffirmed its strong dividend growth potential. As a leading telecom tower REIT with a portfolio of 224,502 communications sites and 28 data center facilities, among other vital infrastructure assets, American Tower continues to thrive due to the mission-critical nature of its assets. Thus, despite the challenging sector landscape, the REIT’s robust financial performance implies ample capacity for sustained dividend growth. Accordingly, I remain bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

FY 2023: Solid Results in a Tough Real Estate Market

If you were invested in the real estate sector last year, then you know that this period presented some tough challenges for numerous companies in the space, and REITs were no exception. The real estate sector is susceptible to fluctuations in interest rates. Therefore, it’s no wonder that with interest rates experiencing multiple hikes between March 2022 and July 2023, finance costs in the sector surged, leading many REITs to close the year with declining profits.

Despite American Tower’s bottom line also being affected by higher interest rates, the telecom tower REIT achieved yet another year of robust revenue growth and increased AFFO per share. This can be attributed to the resilient quality of its assets, which largely mitigated the impact of higher interest expenses.

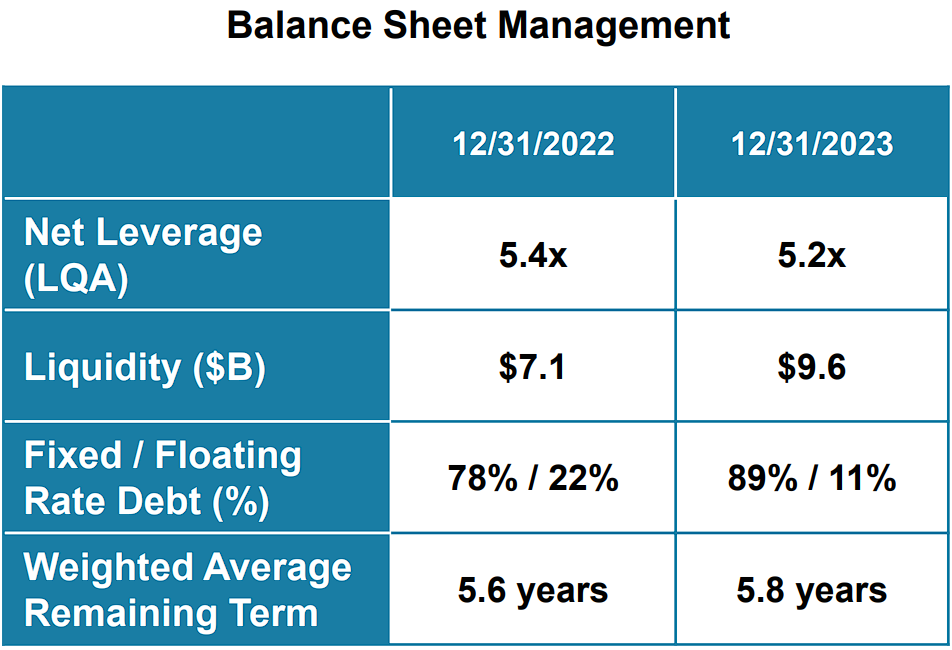

Other factors contributing to its assets’ resilience include the company’s multi-year contracted cash flows and, more importantly, a significant portion of American Tower’s financing being locked at fixed rates. Let’s take a deeper look.

Revenues

In FY 2023, American Tower reported revenues of $11.4 billion, up 4% compared to the previous year, including property revenue of $11.0 billion, which grew by 5% during this period. Revenue growth was powered by tenant billings growing by 7.2%, including organic tenant billings growth of 6.3%, as well as the construction of nearly 3,200 new builds, primarily internationally.

Top-line growth was further boosted by the Data Center division growing by 9%, though the division comprises a tiny chunk of total operations.

The point here is that American Tower had no issue generating robust revenues and even kept growing despite the rather shaky real estate environment. Revenue growth again reminded the market that its cell towers and data centers comprise mission-critical assets for its tenants, who strive for 100% connectivity at all times. Combined with revenues being backed by non-cancelable multi-year leases embedded with rent escalations, you see why there is little to no uncertainty attached to the REIT’s top-line performance.

Interest Expenses & Profitability

Moving toward the bottom line, the major point of interest here was, of course, interest expenses. This is the sole dynamic component capable of significant fluctuation, given the very sturdy nature of its overall business.

Indeed, interest expenses did go up by 18.8% to $1.39 billion. This uptick, however, pales in comparison to the staggering spikes observed among other REITs. For instance, in certain residential REITs, I recall seeing interest expenses spike by 70%, 80% to even doubling over the past year. In contrast, American Tower successfully maintained control over its interest expenses, thanks to its robust balance sheet and, more specifically, a substantial portion of debt being secured at fixed rates.

You see, given the highly resilient nature of the REIT’s assets, as discussed earlier, creditors have relaxed demands. Therefore, American Tower can often secure favorable borrowing terms, including fixed rates and extended maturity periods. By the end of the year, American Tower had effectively locked in 89% of its total debt at fixed rates, with only 11% subject to variable rates.

Hence, the seemingly strong increase in interest expenses wasn’t able to notably impact American Tower’s profitability. In fact, AFFO per share reached a new record, coming in at $9.87 for the year, up 1.1% versus Fiscal 2022.

Dividend Growth Prospects Remain Robust

Moving forward, I believe that American Tower’s dividend growth prospects remain robust. Not only did the company post record AFFO/share last year, but this trend seems poised to last in FY 2024.

Based on management’s outlook, American Tower’s AFFO/share is expected to land between $10.21 to $10.45. The midpoint of this range, $10.30, implies a year-over-year growth rate of 4.5% and a healthy payout ratio of 66%. Thus, American Tower should have no issue continuing its 13-year-long dividend growth streak. In the meantime, its 3.3% dividend yield remains attractive.

Is AMT Stock a Buy, According to Analysts?

Checking Wall Street’s sentiment on the stock, American Tower currently boasts a Strong Buy consensus rating based on 12 Buys and one Hold assigned in the past three months. At $229.92, the average AMT stock forecast implies 16.4% upside potential.

The Takeaway

To sum up, I believe that American Tower’s FY 2023 results showcase the overall resilience of its assets in a challenging real estate landscape. Despite sector-wide pressures stemming from interest rate increases, the REIT managed to achieve robust revenue growth while keeping interest expenses under control and achieving record AFFO/share. Therefore, I think it’s clear American Tower should easily sustain its dividend growth trajectory, thus sustaining its overall bullish case.