American Express (NYSE:AXP) gained in pre-market trading after the credit card company issued a strong outlook. Looking ahead, the company has forecasted FY24 revenue to grow in the range of 9% to 11%, while earnings are likely to be between $12.65 and $13.15 per share. This was above the Street’s earnings estimate of $12.38 per share. Over the long term, AXP is targeting annual revenue growth of 10%, with earnings per share likely increasing in the mid-teens range.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the fourth quarter, American Express reported earnings of $2.62 per diluted share, up by 27% year-over-year. Analysts were expecting AXP to report earnings of $2.64 per share. In addition, revenue came in at $15.8 billion, up by 11% year-over-year, but fell short of the Street’s estimate of $16 billion.

American Express also announced that it plans to increase its quarterly dividend by 17% to $0.70 per share, starting in the first quarter of 2024.

Is AXP a Buy or Sell?

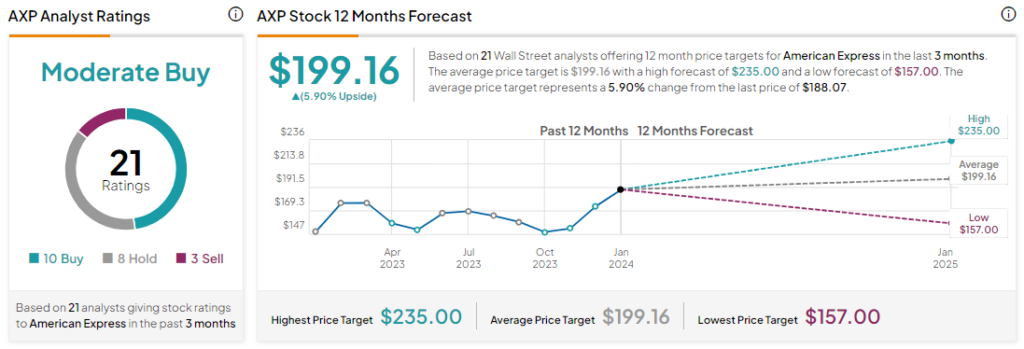

Analysts remain cautiously optimistic about AXP stock with a Moderate Buy consensus rating based on 10 Buys, eight Holds, and three Sells. Over the past year, AXP stock has surged by more than 20%, and the average AXP price target of $199.16 implies an upside potential of 5.9% at current levels.