While several businesses continue to succumb to an unprecedented pandemic, certain semiconductor companies are seeing strong growth driven by demand in end markets like cloud computing, gaming and PCs. Also, the industry’s growth prospects look strong based on tremendous opportunities in 5G technology, AI and data centers.

Shares of chip makers like AMD, Nvidia, Qualcomm and Taiwan Semiconductor have rallied significantly this year. But then, investors are now wondering if there is room for further upside in these stocks. With the help of TipRanks’ Stock Comparison tool, we will place AMD alongside Nvidia to see which stock offers a more compelling investment opportunity.

Advanced Micro Devices (AMD)

AMD’s strong leadership has had a major impact on the company. Not only did CEO Lisa Su steer AMD’s turnaround, she transformed it into one of the strongest semiconductor players that could take on giants like Intel in the CPU (central processing unit) market and Nvidia in the GPU (graphics processing unit) space.

AMD generated revenue growth of 56% in 3Q, driven by strong demand for its PCs, gaming and data center products. Also, adjusted EPS more than doubled primarily driven by higher sales of Ryzen and EPYC processors and a spike in sales of semi-custom products backed by recent launches of new gaming consoles from Microsoft and Sony. The company predicts about 41% revenue growth in 4Q and the full-year as well.

In fact, Rosenblatt Securities analyst Hans Mosesmann feels that the company’s growth trajectory will continue into 2021. Mosesmann raised his 1Q21 and 2021 revenue and earnings estimates after CEO Lisa Su hinted at an analyst conference that the company’s first quarter is likely to be better than seasonal trends.

The analyst noted that AMD typically averages a 10% sequential decline between 4Q and 1Q. That said, Mosesmann explained that he is boosting his 1Q21 estimates given the company’s strong product launches heading into 2021, gaming console demand, recent commentary, and continued market share gains. He also added that AMD has consistently gained PC market share over the last few years, and its CEO sees Zen 3 as likely adding to its share gains.

Reiterating a Buy rating with a $120 price target, Mosesmann summarized, “We continue to believe AMD can capture 50% of the entire x86 CPU market in coming years on technology/product roadmaps, accelerating design pipelines, increasing attach rates of GPUs to optimize EPYC server CPUs, etc. AMD’s CPU and GPU roadmaps will have significant and sustainable advantages in the world of computing that the competition currently do not have.” (See AMD stock analysis on TipRanks)

Meanwhile, AMD is bolstering its position and putting further pressure on rivals with its recently announced acquisition of Xilinx in an all-stock transaction of $35 billion. The deal is expected to expand AMD’s rapidly growing data center business and will increase its total addressable market to $110 billion. The transaction is currently expected to close by the end of 2021 and will be immediately accretive to AMD’s earnings.

Currently, the Street is cautiously optimistic about AMD stock, with a Moderate Buy analyst consensus based on 13 Buys versus 6 Holds and 1 Sell. Given the impressive 96% year-to-date rise, the average price target of $90.41 indicates that shares are fully priced at current levels.

NVIDIA (NVDA)

NVIDIA is a dominant player in the GPU space. The company is gaining from COVID-19 related tailwinds, which accelerated the demand for its graphic cards. NVIDIA’s graphic chips are used in several applications like gaming, data centers and autonomous vehicles. The company beat analysts’ 3Q FY21 expectations, with a 57% growth in revenue and 63% rise in adjusted EPS. Its data center revenue exploded 162% to $1.9 billion, while gaming revenue rose 37% to $2.3 billion.

However, investors weren’t pleased as the company cautioned that it expects its data center revenue to decline slightly on a sequential basis in 4Q, partially driven by a Chinese customer (Huawei) not purchasing Mellanox’s (Nvidia completed acquisition earlier this year) networking products. (See NVDA stock analysis on TipRanks)

This soft data center outlook did not deter Oppenheimer analyst Rick Schafer from reiterating a Buy rating on Nvidia with a $600 price target. In a research note to investors, Schafer explained, “We expect supply issues to linger through F4Q. DC [data center] growth remains solid, up 8% Q/Q as A100/T4 demand offset softer hyperscale spend. The ARM acquisition appears on track, rounding NVDA’s DC footprint while extending edge/mobile reach. Long term AI-driven structural growth/GM thesis intact.”

In September, Nvidia announced a $40 billion deal to acquire chip designer Arm from Softbank. The company stated that it will take 18 months to complete the acquisition. However, the deal has to win regulatory approvals in several jurisdictions around the world.

The deal, if approved, is expected to strengthen Nvidia’s data center business. ARM develops technology that is widely used in low-power chips for smartphones, wearables and tablets, and supplies its technology to most of Nvidia’s competitors.

Looking ahead, Nvidia continues to invest in its data center business to address the demand in AI computing. Also, the momentum for the company’s new Ampere architecture is expected to drive higher sales. Under its data center business, Nvidia launched the NVIDIA RTX A6000 and NVIDIA A40 GPUs, built on the Ampere architecture, in 3Q.

Additionally, within the gaming business, the company unveiled the GeForce RTX 30 Series GPUs, powered by the Ampere architecture and the second generation of RTX. The response was so strong that the GeForce RTX 3080 was immediately sold out following its launch in September.

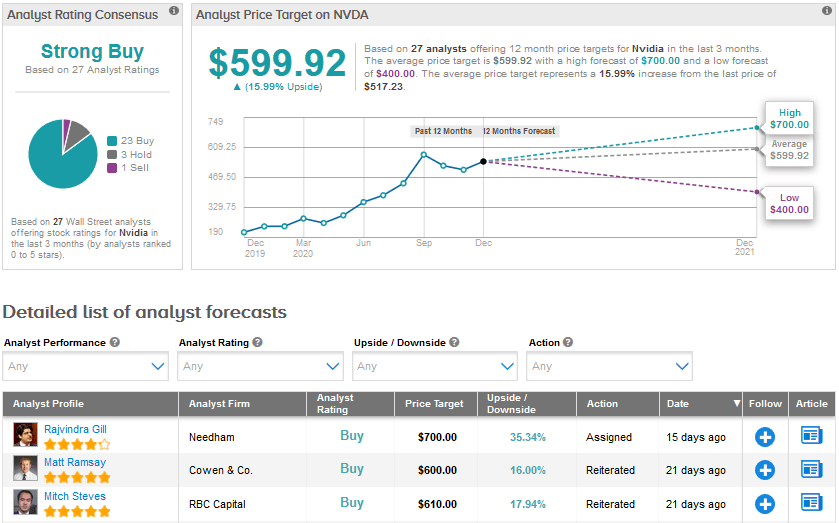

Nvidia shares have already risen by a staggering 120% so far in 2020, and the average price target of $599.92 indicates an upside potential of 16% over the coming months. Nvidia scores a Strong Buy analyst consensus that breaks down into 23 Buys, 3 Holds and 1 Sell.

Bottom line

The Street is bullish about the opportunities for both AMD and Nvidia in data centers and other growth areas. That said, despite its high valuation and strong year-to-date rise, most of the analysts believe that Nvidia stock still has more room to run in the coming months, making it a better pick than AMD.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment