The tech sector has been dominated by two related stories in the past year and a half – the explosion of AI applications, and the rapid appreciation of semiconductor chip companies. The link between the two is the computing power made possible by the latest high-end processor chips. They weren’t originally designed with generative AI in mind and found their initial popularity with video gamers and professional graphic artists. However, their processing capacity, especially when utilized in linked data servers, has been the necessary precursor to AI.

Together, these trends are pointing investors toward the semiconductor chip stocks, and for good reason. But not all chip stocks offer the best opportunities; some are clearly better than others.

Barclays analyst Thomas O’Malley has been watching the chip sector carefully, and notes that investors are preparing for further strong gains through 2025. O’Malley has taken the logical next step, focusing on which chip stocks will make the best buys. He’s been looking closely at both Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC), and has a clear conclusion on which is the superior chip stock to buy. Let’s take a closer look.

AMD

The first chip stock we’ll look at is Advanced Micro Devices, AMD, one of the semiconductor sector’s long-time leaders. The company is a giant by any standard, with a market cap of $290.3 billion – and while it’s not in Nvidia’s multi-trillion dollar league, it’s still the 6th-largest chip company in the world. AMD offers customers a high-quality product portfolio, based on chips suitable for data centers and capable of supporting the processing needs of generative AI applications.

The company’s chief products include its Ryzen AI mobile processors, which are also used in graphics-intensive gaming, and its Versal AI core adaptive SoCs, as well as the Instinct GPU accelerators, the Alveo Adaptive accelerators, and the EPYC server processors. Taken together, these product lines give AMD’s customers a wide range of capabilities to choose from, and have found use in everything from gaming to data centers to supercomputers. For AMD, the bottom line for its chips and processors is speed, to meet the needs of the end-user. And that focus on speed has made AMD a favorite among AI developers.

Users have clearly recognized AMD’s overall quality, and the company has been expanding its market share in recent months and quarters. In 2023, the company saw its CPUs make a modest gain against sector leader Intel (see below), with AMD’s market share rising to 31.1% according to industry tracking firms.

For investors, the key point here is AMD’s solid gains in price. In the last 12 months, the company’s shares are up 88%.

AMD’s share price outperformance has been backed up by sound financial results. The company last reported quarterly financials on January 30, for 4Q23. In that quarter, AMD’s revenue came to $6.2 billion, up 10% from 4Q22 and $60 million ahead of the forecast. The bottom line non-GAAP EPS of 77 cents per share was in line with expectations.

For Barclays analyst O’Malley the key point here is AMD’s ability to slowly expand its market share in a highly competitive environment. He writes, “AMD continued its server CPU share gains in Dec/Mar. Genoa/Bergamo series processors were called out as a point of strength in the December quarter, noting the processor generation seeing double digit sequential growth. We see further share gains near term until Sierra Forest comes in later this year… We continue to see AMD taking share in the server market in 1Q24 and holding share stable through the remainder of the year moving from 25% in 4Q23 to 27% through 2024…”

Summing up, O’Mally adds, “AMD is the best positioned name in our coverage for AI in CY25 and beyond, in our view, with tailwinds across server CPU and PCs.”

All told, these comments support the analyst’s Overweight (i.e. Buy) rating on AMD, while his price target, now set at $235, implies a one-year upside potential of 29%. (To watch O’Malley’s track record, click here)

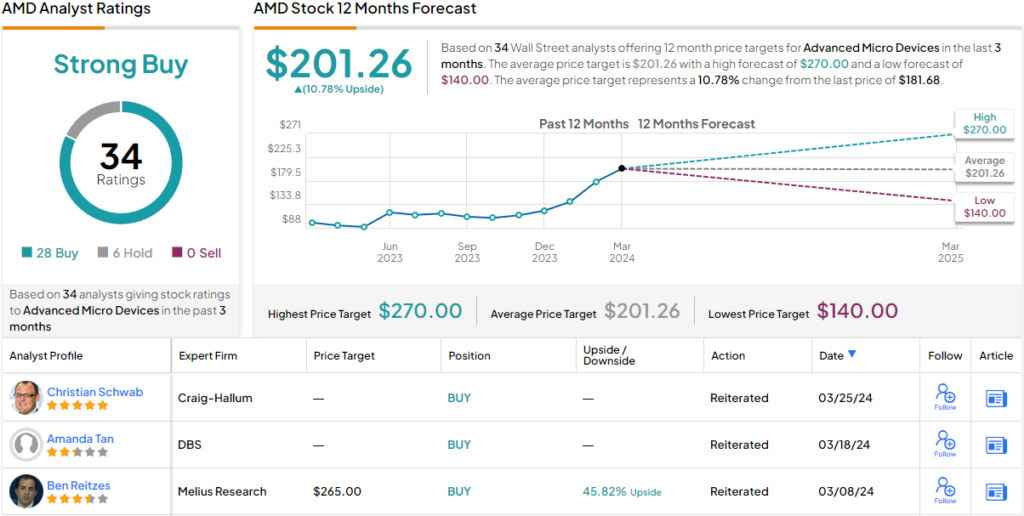

Overall, Wall Street gives AMD shares a Strong Buy consensus rating, based on 34 analyst reviews that include 28 Buys and 6 Holds. The stock is selling for $181.43 and its $201.26 average price target suggests it will appreciate by ~11% in the next 12 months. (See AMD stock forecast)

Intel

Next on Barclays’ list is Intel, another of the chip industry’s leading names – and a long-time leader in the personal computer processing chip segment. PCs are a huge market for chip makers, and even after several years of intense competition, Intel still holds a leading position in the supply of CPU chips, with a market share of approximately 63%. That success has propped up Intel’s market cap, which at $178 billion makes it the 8th-largest of the world’s chip makers.

While dominating the PC CPU market has clearly been beneficial for Intel, the future of semiconductors is clearly going to revolve around AI. We won’t stop needing chips for our PCs, but the chip makers are going to find – indeed, are already finding – that the need of AI computation presents a far more lucrative field for their products. And until recently, Intel has simply not been part of that game.

The company did not have AI-capable chips on the market in 2022 or in 2023, preferring to maintain its lead in existing CPUs. Intel’s line-up of new and upcoming products, however, shows that the company is moving toward AI. Yes, Intel is producing newer versions of Core processors, but it is also releasing the fifth-generation Xeon server chips, and the new Gaudi3 was designed to meet the needs of generative AI.

In addition, the US government has prioritized reshoring semiconductor chip production – and design – back to the US, and has backed that policy with funding through the CHIPS Act. Intel stands to receive as much as $8.5 billion in CHIPS Act funds. Additionally, it can tap into more than $11 billion worth of other Federal loans. This Federal support targets projects such as Intel’s new chip factory in New Mexico.

On the financial side, Intel saw both revenues and earnings slide from the end of 2022 and into 2023 – but both have been tracking back upward since 1H23. The company’s last quarterly report covered 4Q23 and showed a top line of $15.4 billion, $230 million better than had been anticipated and 10% better than the prior-year period. Intel recorded earnings of 54 cents per share by non-GAAP measurements, 9 cents per share above the forecast. That was the good news.

The bad news came from the full-year results and forward guidance. The top line for 2023, $54.2 billion, represented a 14% drop from 2022, and the full-year earnings, $1.05 per share in non-GAAP EPS, was down by 37% year-over-year. Intel’s guidance for 1Q24 revenue was set in the range between $12.2 billion and $13.2 billion, well below the $14.25 billion consensus figure.

So we shouldn’t wonder that INTC shares are down 16% this year.

Intel’s mix of sound current results and disappointing guidance, along with the state of the PC chip market and the challenges the company will face in entering the AI chip segment, have colored O’Malley’s take. The Barclays analyst writes, “The company is now saying both revenue and EPS will grow y/y in each quarter, which signs the company up for hefty financial checkpoints along with the existing technological hurdles this year… PCs have bottomed and spending cuts should help the model, but uncertainty around the execution of the technology roadmap keeps us from getting more constructive.”

O’Malley goes on to put an Equal Weight (i.e. Neutral) rating on shares of INTC, and he gives the stock a $44 price target, suggesting just 5% upside for the next 12 months.

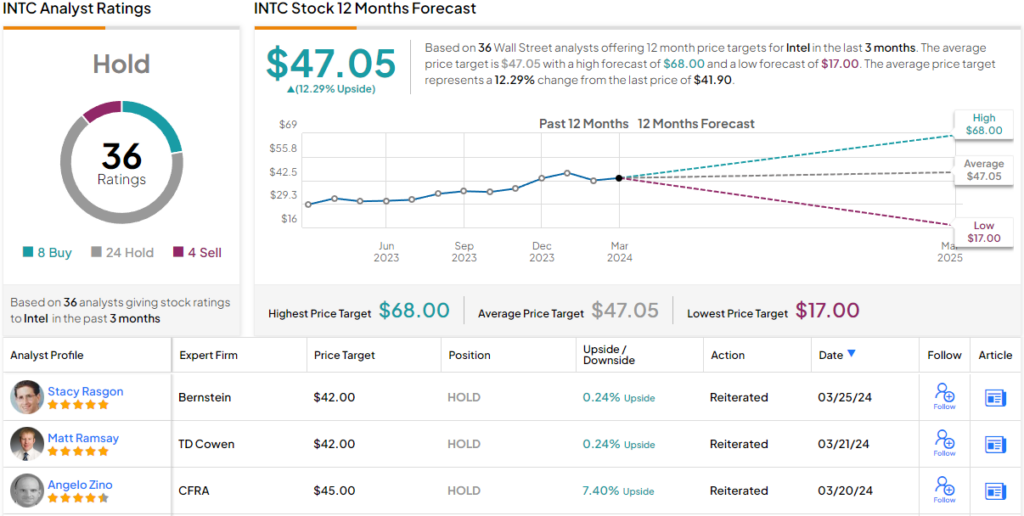

Wall Street, generally, is showing some caution here. The stock has 36 recent analyst recommendations, and these include 8 Buys, 24 Holds, and 4 Sells – for a Hold consensus rating. The shares are currently trading for $41.92 and their $47.05 average price target implies ~12% one-year increase from that level. (See Intel stock forecast)

When the Barclays analyst lays out AMD and Intel stocks side-by-side, his choice is clear: AMD is the superior stock to buy.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.