Semiconductor player Advanced Micro Devices (NASDAQ:AMD) is set to release its first quarter Fiscal 2024 results on April 30, after the market closes. Backed by the solid artificial intelligence (AI) wave, AMD is expected to report a stellar performance for its Data Center segment. However, AMD’s other end markets, such as Gaming and Embedded, are expected to impact its results.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Wall Street’s Expectations from AMD’s Q1

The Street expects AMD to post adjusted EPS of $0.62 (up 3.33% year-over-year) and revenues of $5.48 billion (up 2.4% year-over-year). Meanwhile, AMD has guided for Q1 revenue of $5.4 billion +/- $300 million. In the comparative prior-year quarter, AMD reported adjusted EPS of $0.60 on revenues of $5.35 billion.

Notably, AMD has exceeded the consensus estimates in six out of the past eight consecutive quarters. Analysts see risks of heated competition from ace chipmaker Nvidia (NASDAQ:NVDA) and a slower-than-expected ramp from the MI300X accelerator chips.

TD Cowen Analyst Weighs In

Ahead of AMD’s Q1 print, TD Cowen analyst Matt Ramsay lifted the price target on AMD stock to $200 (27.1% upside) from $185 and maintained a Buy rating. Ramsay is particularly encouraged by the future sales potential of AMD’s MI300X accelerator.

The five-star analyst increased the 2025 sales estimates for MI300X to $4.5 billion from $4 billion, citing increased ramp from several customers. Meanwhile, AMD expects this advanced chip to generate sales of more than $3.5 billion in the full year 2024.

Ramsay also raised his earnings per share (EPS) guidance for FY27 to roughly $10, representing a CAGR (compound annual growth rate) of 40% from 2023. AMD remains one of the top picks for TD Cowen. The analyst sees solid demand potential for AMD’s recent launch of its 4-nanometer technology for use in laptops and desktops, set to disrupt the (PC) personal computer market.

Ramsay ranks #10 out of more than 8,800 analysts ranked on TipRanks. He boasts an attractive 30% average return per rating in the past year, with a success rate of 67%.

Is AMD a Buy, Sell, or Hold?

Despite the perceived foreseeable weakness in the Embedded and Gaming segments and the challenges in ramping up AMD’s MI300X chips, analysts have awarded AMD stock a Strong Buy consensus rating. This is based on 25 Buys versus seven Hold ratings received in the past three months on TipRanks.

Also, the average Advanced Micro Devices price target of $204.15 implies 29.7% upside potential from current levels. In the past year, AMD shares have gained 75.5%.

Insights from Options Trading Activity

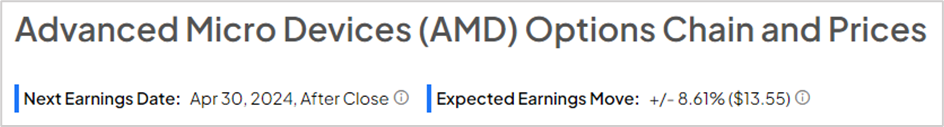

It’s worth noting that options traders are pricing in a +/- 8.61% move on earnings, considerably higher than the previous quarter’s earnings-related move of -2.54%.

The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Key Takeaways

AMD is undoubtedly poised to be one of the largest beneficiaries of the AI-driven tech world. With the company advancing newer chips and technologies, it is expected to witness accelerated demand for its products. Despite short-term headwinds, Wall Street is highly optimistic about AMD’s stock trajectory.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue