Movie theater giant AMC Entertainment (NYSE:AMC), a key player in the “meme stock” movement, has suffered significant stock declines, with shares down more than 93% in the past year. Many investors remain hopeful of a highly anticipated turnaround and expect the upcoming Q4 earnings to be a positive catalyst for the stock. However, the fluctuating history of AMC’s stock price and skepticism among Wall Street analysts make the stock an unpredictable bet.

AMC is scheduled to report its fourth-quarter earnings on February 28. Analysts expect the company to report a narrower loss per share of $0.57 compared to $2.29 in the prior-year quarter.

The Planet of the Apes

Leawood, Kansas-based AMC Entertainment is a leader in the theater business, managing over 900 theaters/10,000 screens in the U.S. and Europe.

AMC became a favorite among the “Apes” – a term frequently used to describe AMC retail investors, taking on meme stock status. It observed a colossal surge of over 2,800% in its stock value from the end of 2020 to June 2021. However, the years following saw drastic declines, with the stock falling 85% in 2022 and a further 83% in 2023.

Still Waiting for the MOASS

A cohort of Apes are still holding strong, waiting for the MOASS (“mother of all short squeezes”) to drive the stock’s price back into the stratosphere. Investors anticipate that AMC’s upcoming fourth-quarter earnings report could be the catalyst.

The thesis is that robust results may attract increased investment, potentially triggering short sellers (according to MarketSmith, shares sold short account for nearly 15% of all shares outstanding) to cover their short positions by purchasing the stock, driving share prices even higher.

Sadly, for those waiting for the MOASS, positive quarterly results are no guaranteed turning point. Last quarter, when AMC beat earnings estimates on a 45% rise in sales to $1.41 billion, the stock fell by 13.7% the next day.

Is AMC a Buy, Sell, or Hold?

Analysts covering AMC stock have been less hopeful about its near-term prospects, given the ongoing slower post-pandemic core demand and the potential negative impact of recent Hollywood strikes.

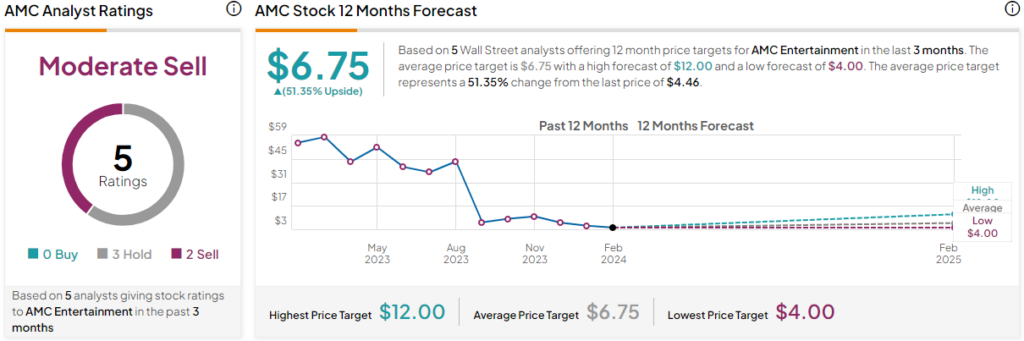

Ahead of the results, Wedbush analyst Alicia Reese maintained a Hold rating on AMC with a price target of $6. While Reese is positive about AMC gaining further market share and the possibility of the company upgrading its European circuit, she remains on the sidelines due to its huge debt burden and the lack of a dividend.

Meanwhile, Roth MKM analyst Eric Handler lowered the price target to $4 from $5 while maintaining a Sell rating.

AMC is currently rated a Moderate Sell based on three Hold and two Sell ratings. The average price target represents an upside of 51.4% from the current levels.

Key Takeaways

AMC Entertainment, a harbinger of the “meme stock” era, has seen its stock suffering massive declines over the past few years. Despite a firm belief among retail investors in the potential for a “mother of all short squeezes,“ a turnaround remains a tantalizing yet uncertain prospect. The historical patterns of price volatility and the outlook of professional analysts suggest caution.

As AMC warned investors about the fluctuations in its price and trading volumes in a recent filing, the stock is “highly speculative and involves risk…be prepared to incur the risk of losing all or a substantial portion of your investment.”