Shares of the fabless semiconductor design company, Ambarella (NASDAQ: AMBA) were on a downslide in pre-market trading at the time of publishing on Wednesday after the company’s guidance for the second quarter left investors disappointed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Looking forward, the company has guided revenues in the range of $60 million to $64 million in Q2, below the consensus estimates of $66.8 million. On an adjusted basis, Q2 gross margin is expected to be between 62.5% and 64.5%.

In Q1, Ambarella’s revenues declined by 31% year-over-year to $62.1 million, falling short of analysts’ forecasts of $66.87 million. More disappointingly, the company swung to an adjusted loss in Q1 of $0.15 per share versus adjusted earnings of $0.44 per share in the same period last year. However, this adjusted loss was still narrower than analysts’ expectations of a loss of $0.20 per share.

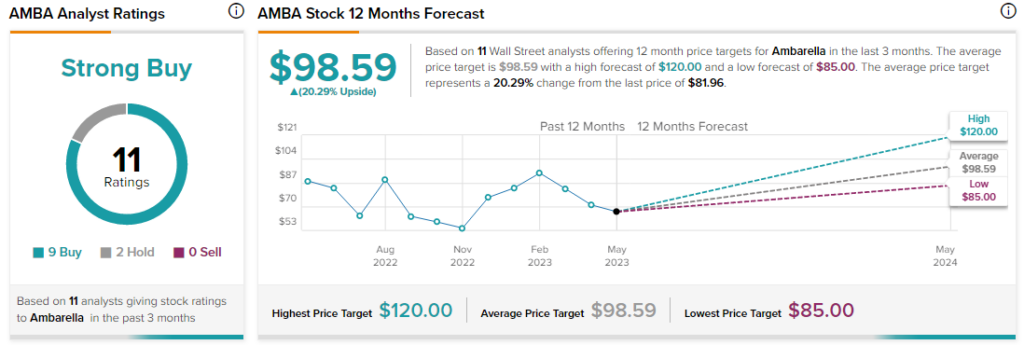

Overall, analysts are bullish about AMBA stock with a Strong Buy consensus rating based on nine Buys and two Holds.