Amazon.com (NASDAQ:AMZN) is likely to face no roadblocks in the $3.9 billion acquisition of 1Life Healthcare Inc. (ONEM), a primary care provider which operates under the name One Medical. The Federal Trade Commission (FTC) has passed the deadline to raise objections to the acquisition, thus clearing the way for the deal to close later this week.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Even so, the FTC will continue its investigation of the merger, as per a WSJ report. The regulator is concerned that Amazon’s takeover of One Medical might stifle competition. Another cause of worry is how Amazon plans to use the sensitive consumer health data held by One Medical.

Brief Background of Deal

Amazon announced the acquisition in July 2022. The e-commerce giant valued the all-cash deal at $18 a share or $3.9 billion, including debt. It is worth highlighting that Amazon will gain access to more than 180 medical offices in 25 markets in the U.S.

A slowdown in Amazon’s e-commerce business is likely to be one of the drivers for this deal. Moreover, the One Medical acquisition should help Amazon strengthen its healthcare portfolio, because it provides a variety of telemedicine services.

What is the Amazon Stock Prediction?

Amazon has a stronghold in the e-commerce, cloud computing, and digital advertising markets. Further, the company continues to try its luck by investing in new businesses to diversify revenue sources. Lastly, management’s efforts to improve profitability with the biggest headcount reduction in the company’s history and closing of unprofitable businesses are encouraging.

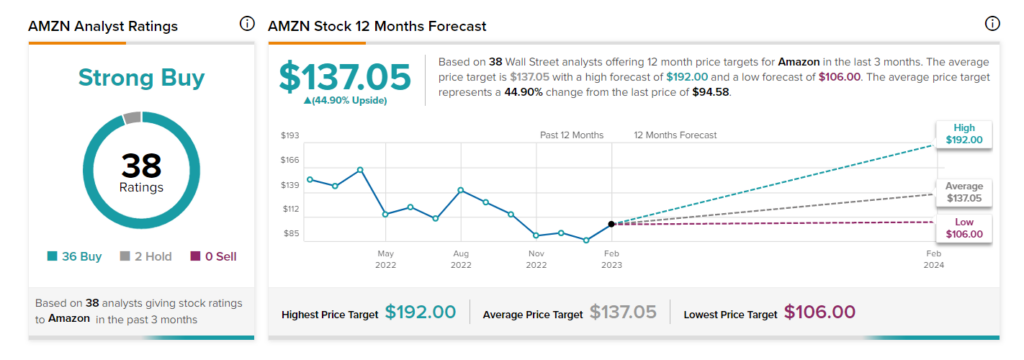

Wall Street is also highly bullish on AMZN stock with a Strong Buy consensus rating based on 36 Buys and two Holds. The average price target of $137.05 implies 44.9% upside potential from current levels. Shares of the company have gained 10.2% already in 2023 so far.