Amazon (AMZN) said its cloud computing platform, Amazon Web Services (AWS), is back to normal after a major outage on Monday that disrupted thousands of websites and apps across the world. The issue took down several popular platforms, including Snapchat (SNAP), Reddit (RDDT), Roblox (RBLX), and Venmo — showing how much global businesses depend on Amazon’s cloud network.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amazon said most systems were restored by the afternoon, but some services such as Config, Redshift, and Connect were still clearing data delays. Despite the problem, Amazon shares rose 1.6% on Monday to close at $216.48, as investors saw the issue as short-term and unlikely to hurt the company’s growth.

Network Glitch Triggers Massive Outage

Amazon said the outage started at its US-EAST-1 data center in Virginia, one of its biggest and most-used cloud hubs. The problem came from a Domain Name System (DNS) error that stopped apps from reaching DynamoDB, a key AWS database used by millions of customers.

The company later found the cause to be a fault in a tool that checks the health of AWS’s network load balancers, which control traffic between servers. AWS said the issue was fixed by 3 p.m. Pacific Time, but noted it was the third major outage in five years linked to the same site.

Outage Shows Heavy Cloud Dependence

The outage caused problems for banks, telecom firms, major U.S. carriers, and online platforms around the world. In the U.K., Lloyds Bank, Vodafone, and BT Group all faced temporary service issues.

Analysts said the event showed how dependent the world has become on a few big cloud providers, namely Amazon, Microsoft (MSFT), and Alphabet (GOOGL). Cybersecurity experts warned that even short outages can cost millions in lost work and urged companies to use backup systems across different cloud providers.

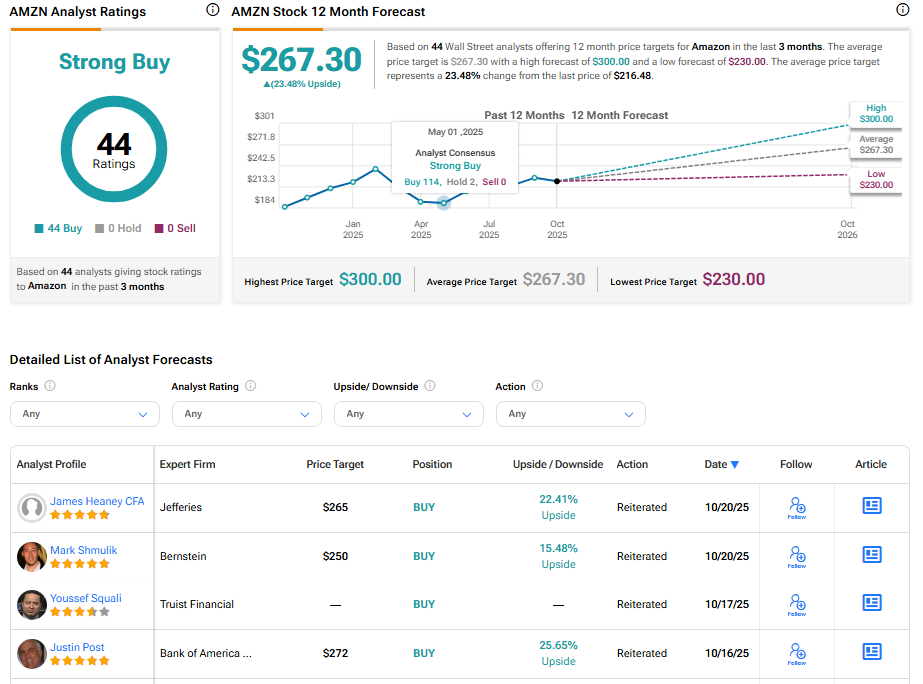

Is AMZN Stock a Buy?

Turning to Wall Street, Amazon’s shares currently boast a Strong Buy consensus rating. According to TipRanks, this is based on 43 Buys issued by analysts over the past three months. The average AMZN price target of $267.30 implies 23.48% upside from current levels.