Online retail giant Amazon (AMZN) was, for a while, well on its way to being a powerhouse in the gaming market. But reality apparently had something different to say, as recent reports found most of Amazon’s gaming aspirations shut down. Amazon pared back its updates for New World: Aeturnum, and also mostly shuttered plans for an MMO based around The Lord of the Rings. This hit investors hard, and Amazon shares fell nearly 2% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amazon recently fired up some layoffs in Amazon Games, as well as across its overall operation. But that ultimately meant an end to updates in New World: Aeturnum, a game that is actually still quite popular. In fact, New World recently released its Season 10 updates, along with the Nighthaven update, which will apparently prove to be the last.

Amazon Games, via representatives, noted, “After four years of steady content updates and a major new console release, we’ve reached a point where it is no longer sustainable to continue supporting the game with new content updates.” But those who still want to play the game can, and PlayStation Plus subscribers can also keep the game going on Extra and Premium tiers.

That Was Not All

And as Amazon moved to shut down a game in progress, it also moved to potentially shutter a game that did not even exist yet. Reports suggest that the MMORPG based around The Lord of the Rings has been canceled, though other reports suggest that there may yet be some room for it to come out later.

Amazon got into games in the first place because it saw an opportunity, but perhaps went after the wrong kind of games. Reports suggest that Amazon still plans to pursue “…casual and AI-focused games” such as Courtroom Chaos: Starring Snoop Dogg, a game that features Snoop as a judge between players staging courtroom-style debates.

Is Amazon a Good Long-Term Investment?

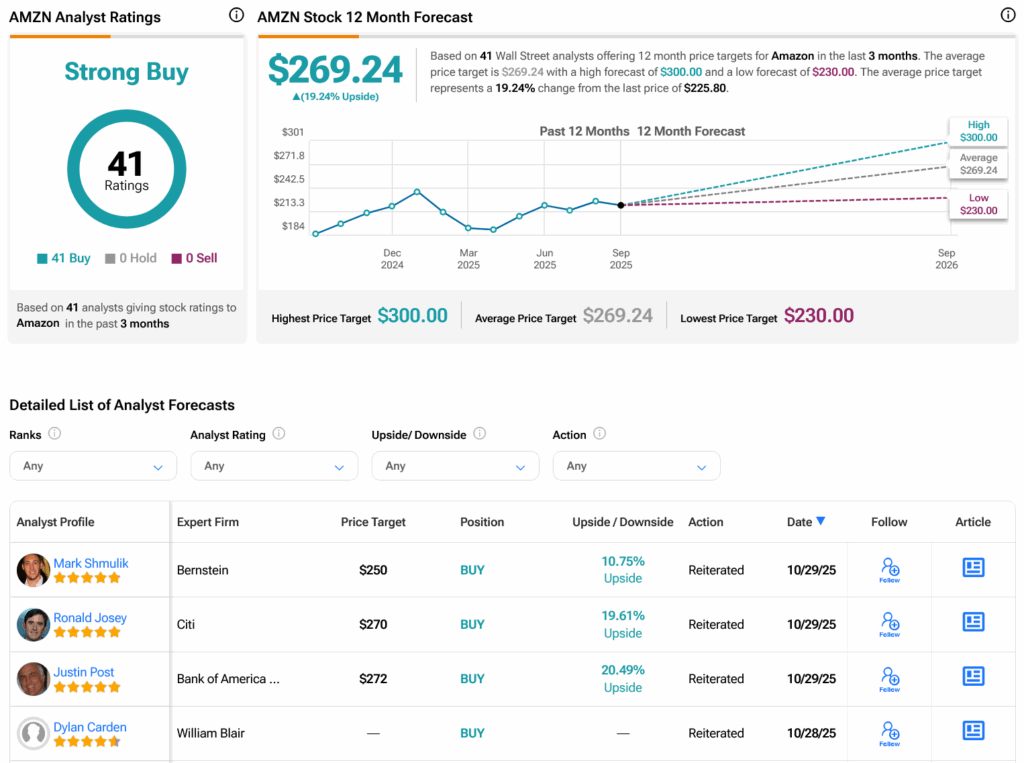

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 41 Buys assigned in the past three months, as indicated by the graphic below. After a 23.55% rally in its share price over the past year, the average AMZN price target of $269.24 per share implies 19.24% upside potential.