E-commerce and cloud computing giant Amazon (AMZN) is scheduled to announce its third-quarter results after the market closes on Thursday, October 30. AMZN stock has risen by just 5% year-to-date, making it the worst-performing Magnificent 7 stock. Investors have been concerned about the slower revenue growth of the company’s Amazon Web Services (AWS) cloud unit compared to Microsoft’s (MSFT) Azure and Alphabet’s (GOOGL) Google Cloud. Also, AMZN had issued unimpressive Q3 profit guidance in July, further spooking investors, who are eager to see returns on the company’s massive investments in artificial intelligence (AI).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

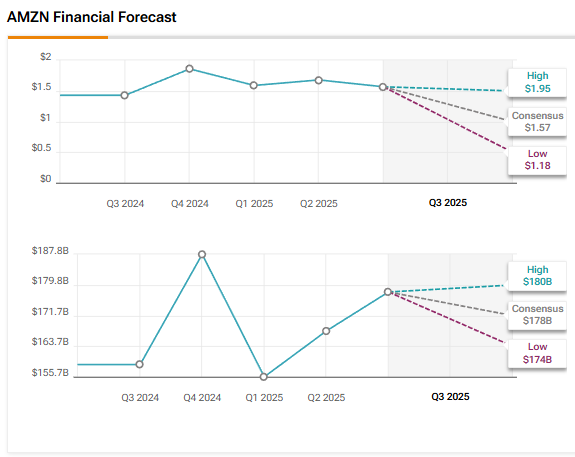

Wall Street expects AMZN to report a 10% growth in Q3 earnings per share (EPS) to $1.57, with revenue expected to rise about 12% to $178 billion.

Meanwhile, ahead of the results, news emerged that Amazon is slashing 14,000 jobs. In fact, the tech giant reportedly plans to eliminate up to 30,000 jobs as it tries to lower costs and reverse pandemic-era overhiring.

Analysts’ Views Ahead of Amazon’s Q3 Earnings

Heading into Q3 results, Wolfe Research analyst Shweta Khajuria reiterated a Buy rating on Amazon stock with a price target of $270. The 5-star analyst raised her 2026 operating income estimates by 3.5% following an analysis on the impact of automation and retrofitting legacy fulfillment centers on Amazon’s hiring needs. Khajuria sees $2 billion in annual savings from automation and $1 billion in annual savings from retrofitting fulfillment centers over five years.

Meanwhile, Khajuria contends that Amazon’s retail segment remains underappreciated. She sees significant margin upside from increased automation and the need for fewer employees. Moreover, the top-rated analyst expects AWS to remain a key area of focus for the next 12-18 months, given the importance of AI and AWS’s overall importance to Amazon’s enterprise value.

Additionally, KeyBanc analyst Justin Patterson recently initiated a Buy rating on Amazon stock with a price target of $300. The top-rated analyst expects advertising and grocery expansion to support AMZN’s growth. Patterson added that advertising is driving Amazon’s retail gains and could help the grocery business to become a bigger contributor over the medium term.

Meanwhile, Patterson contends that investors are underestimating a rebound in AWS. He noted that the slower growth in AWS compared to peers is due to scale constraints rather than lost demand. Patterson is optimistic that new data center projects such as Project Rainier, which will power AI startup Anthropic’s training clusters, could help accelerate growth in 2026. He believes that AWS remains well-positioned to capture AI-driven workloads once new capacity comes online.

AI Analyst Is Bullish on Amazon Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to AMZN stock with a price target of $251, indicating about 9.5% upside potential. TipRanks’ AI analyst’s rating is based on the company’s solid financial performance and positive earnings call sentiment, highlighting robust growth and strategic advancements.

That said, AI analysis highlights that AMZN’s high valuation and mixed technical indicators temper its overall score.

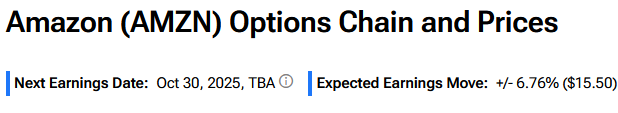

Options Traders Anticipate a Major Move on AMZN’s Q3 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.76% move in either direction in AMZN stock in reaction to Q3 2025 results.

What Is the Price Target for Amazon Stock?

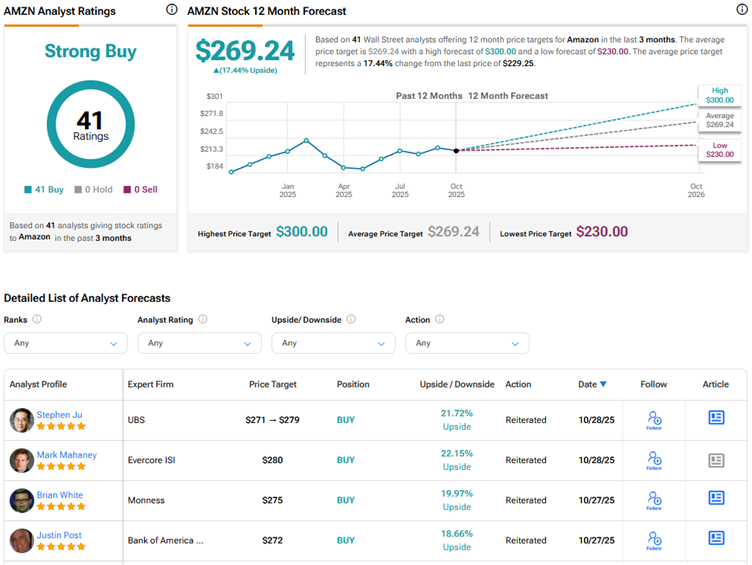

Currently, Wall Street has a Strong Buy consensus rating on Amazon stock based on 41 unanimous Buys. The average AMZN stock price target of $269.24 indicates a 17.4% upside potential from current levels.