Amazon (NASDAQ:AMZN) through its subsidiary, Amazon Web Services (AWS), is investing about $12.7 billion into cloud infrastructure in India by 2030. With this investment, the e-commerce giant plans to expand its cloud products and meet growing demand in the country.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Additionally, the capital infusion is anticipated to generate about 131,700 full-time jobs annually, including positions in engineering, telecommunications, construction, and facility maintenance.

The e-commerce giant had already invested nearly $3.7 billion in India from 2016 to 2022. As a result, by 2030, Amazon will have invested a total of $16.4 billion. AWS currently operates two data centers in India, which are situated in the cities of Mumbai and Hyderabad.

Amazon said that a number of significant clients utilize its cloud services in India, ranging from big businesses like Ashok Leyland, Axis Bank, and HDFC Life to government agencies like the Ministry of Electronics and Information Technology.

The announcement comes at a time when Amazon is undertaking cost-cutting measures across its other businesses. Further, the overall demand for cloud services remains slow due to challenging macroeconomic conditions. Last month, the company said that AWS’ revenue growth in April had dropped from 16% in the first quarter of 2023 to roughly 11%.

Is Amazon Stock a Buy, Sell, or Hold?

AMZN stock sports a Strong Buy consensus rating on TipRanks based on 35 Buy and one Hold recommendations. Analysts’ average price target of $134.24 implies 16.23% upside potential from current levels.

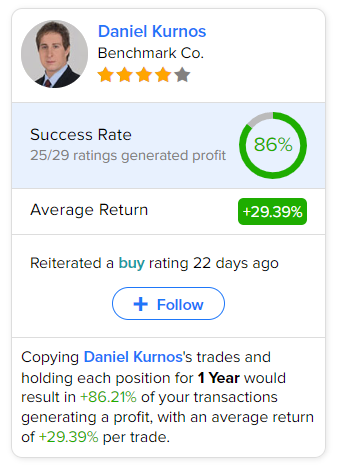

As per TipRanks data, the most accurate analyst for AMZN stock over a one-year time frame is Daniel Kurnos of Benchmark Co. The analyst has had an 86% success rate in his ratings of the stock, with an average return of 29.39% per trade. Click on the image to learn more.