Online retail giant Amazon (NASDAQ:AMZN) is testing a new feature on its app to encourage shoppers to make recurring purchases to fuel growth. Per a Wall Street Journal report, Amazon introduced a “Buy Again” feed on the homepage to offer personalized recommendations to users by leveraging the customer’s order history. This initiative coincides with a period of moderating growth in Prime memberships and a slowdown in consumer spending, as the report highlighted.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Besides for the “Buy Again” feature, Amazon is also delving into a subscription-based ordering option known as “Subscribe & Save” to promote more frequent purchases and encourage customers to spend more on its platform. Along with these measures, the company is enhancing delivery speed to boost Prime membership. During the Q2 conference call, Amazon’s CEO Andrew Jassy highlighted that more than half of Prime members’ orders arrived on the same day or the next day. Additionally, Amazon has substantially expanded the range of items available for free shipping with a Prime membership.

Further, Amazon has increased the number of deals and promotions to offer more value to its customers and, in turn, drive its membership.

In addition to emphasizing expanding its Prime membership, Amazon strives to enhance its profitability through cost discipline. In addition, it is prioritizing integrating AI (artificial intelligence) into AWS’ (Amazon Web Services) suite of services to defend and grow its leadership in the cloud space.

With this backdrop, let’s look at what the Street recommends for Amazon stock.

Is Amazon Stock Expected to Go Up?

Amazon stock has gained about 54% year-to-date. Moreover, analysts see further upside potential from current levels. The company is lowering costs and focusing on driving profitability. Further, it is taking steps to drive its Prime memberships and monetize Prime Video through ads. Additionally, the signs of stabilization in the cloud business and an expected reacceleration in growth led by AI bode well for future growth.

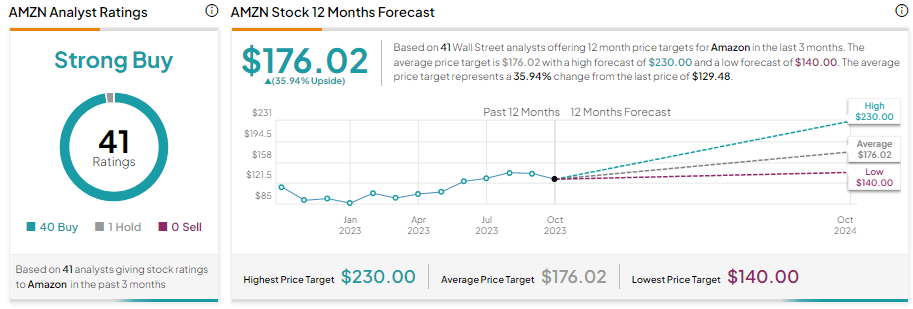

These positives are well reflected in analysts’ bullish outlook on Amazon stock. With 40 Buy and one Hold recommendations, AMZN stock sports a Strong Buy consensus rating. Analysts’ average price target of $176.02 implies 35.94% upside potential from current levels.