Granted, no one will ever mistake e-retailing giant Amazon (NASDAQ:AMZN) for a Canadian stock. But it’s certainly working to cement its position in the Great White North, and recent augmentations to its infrastructure in the country have emerged all over. The moves haven’t been lost on shareholders, who gave Amazon a fractional boost in Wednesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Amazon bolstered its Canadian presence by rolling out the AWS Canada West (Calgary) Region. It also brought out a new economic impact study that detailed just what this new region means to the Canadian people: an annual investment of over $17.9 billion through 2037 and roughly 9,300 full-time jobs—or their equivalent—annually.

With the new region, users will be able to get in on the full range of AWS technologies, starting with data analytics and working all the way up to full-on artificial intelligence. This latest region added to the roster gives Amazon a total of 105 availability zones in 33 locations, and there are plans to add several more in the months ahead.

Branching Out Elsewhere Too

Amazon isn’t just branching out with its AWS availability. It’s also working to bring Diamond Sports Group’s lineup of regional sports networks (RSNs) under its umbrella. Diamond Sports Group entered bankruptcy protections back in March and has been frantically working to stay viable ever since. With Amazon involved as a streaming provider of RSN content, that might help address most, if not all, of Diamond’s cash problems. Amazon has already found value in streaming football, so branching out into other sports isn’t out of line either.

Is Amazon a Buy or Sell?

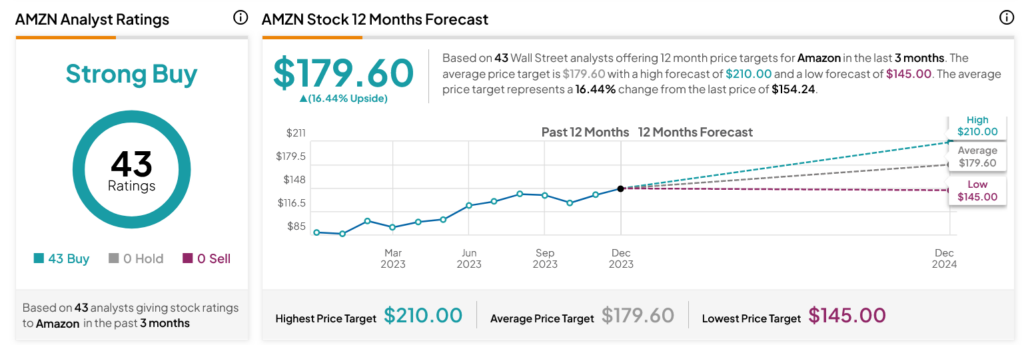

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 43 Buys assigned in the past three months, as indicated by the graphic below. After a 78.21% rally in its share price over the past year, the average AMZN price target of $179.60 per share implies 16.44% upside potential.