Tech giant Amazon (NASDAQ:AMZN) is aggressively expanding its sports content to compete with sector leaders such as Walt Disney (NYSE:DIS) and Netflix (NASDAQ:NFLX). According to a report from the Wall Street Journal, Amazon is in discussions to make a strategic investment in Diamond Sports Group, the largest regional sports programmer. This move is part of Amazon’s broader strategy to enhance and diversify its sports content offerings on Prime Video.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Per the report, Diamond Sports Group has recently filed for bankruptcy. However, it hosts the broadcasts of over 40 major sports teams nationwide. Moreover, Diamond will continue operating its cable networks through its existing partnerships. This makes it an attractive investment for companies operating in the streaming business.

Benefits of the Deal

The exact amount of money Amazon intends to invest and the valuation details remain undisclosed. However, if a deal is reached, Amazon’s Prime Video platform will become the streaming destination for Diamond’s extensive sports content. The move will likely augment the sports content library on Prime Video, reinforcing Amazon’s competitive stance in the streaming industry. AMZN already holds streaming rights for National Football League (NFL) games and is expected to pursue broadcasting deals for the National Basketball Association (NBA).

Related News: Blue Origin Postpones Space Flight

In another related news, Jeff Bezos’ space venture, Blue Origin, seems to be facing challenges. According to a Wall Street Journal report, the company postponed the launch of its space flight due to a technical snag with a ground system at the launch site. The success of this mission is critical for Blue Origin, which aims to offer space trips. It is worth noting that setbacks from a failure during an uncrewed mission last year had a notable impact on the company’s suborbital launch business.

Is Amazon Stock Expected to Go Up?

Amazon stock is up over 83% year-to-date. Its focus on reducing the cost structure, investments in Artificial Intelligence (AI), enhancements to its Prime membership, and strength in the advertising and cloud business augur well for growth.

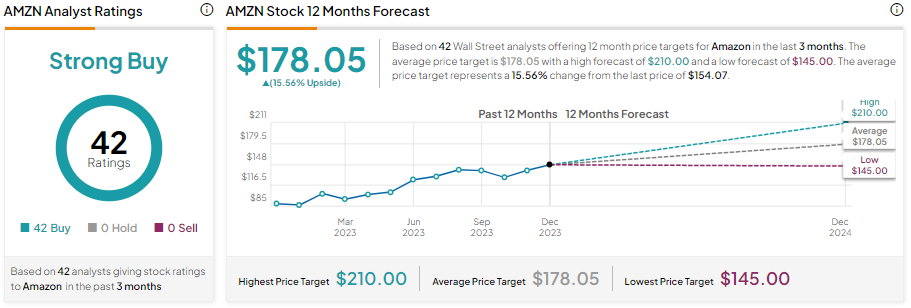

Wall Street analysts are bullish about AMZN’s prospects, with all 42 analysts covering the stock recommending a Buy. Further, the analysts’ average price target of $178.05 implies 15.56% upside potential from current levels.