Back during the pandemic, e-commerce site builder Shopify (NASDAQ:SHOP) distinguished itself as the weapon of choice to keep brick-and-mortar stores from shutting down completely. However, there are signs that Amazon (NASDAQ:AMZN) may plan to take over that market itself, causing Shopify shares to slip in Tuesday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The idea that’s likely unsettling Shopify investors is Amazon’s “Buy with Prime” concept, a tool that gives stores access to a range of Amazon tools despite not directly selling on Amazon. Formerly, Buy with Prime was available by invitation only, which kept the pool of potential competition comparatively thin.

However, now, Amazon plans to roll out the service to more businesses. That’s likely to put Shopify on the back foot. Buy with Prime includes, among other things, access to payments and delivery mechanisms that will improve the businesses’ competitive capability while also giving Amazon a piece of their action.

Shopify was already losing ground. Particularly unsettlingly, it was losing ground going into the holiday shopping season. Amazon stepping in directly on its turf and offering businesses a better deal will only compound Shopify’s problems. Buy with Prime users are already seeing increased sales—an average of 25%, based on Amazon’s own data—that’s going to provide a strong reason to make the move over to Amazon’s services.

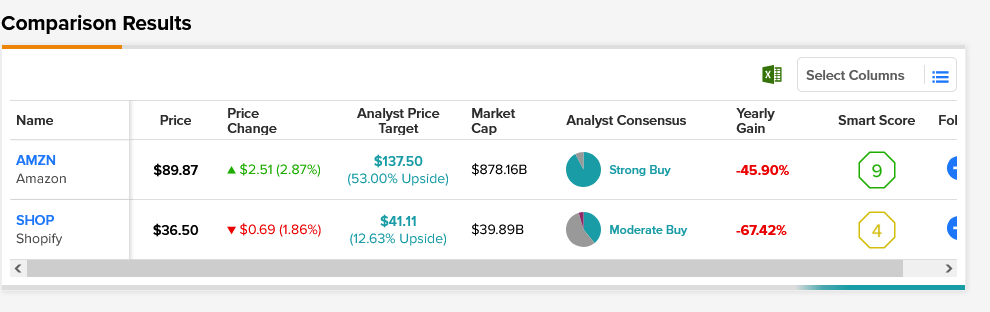

While both Amazon and Shopify are down on a year-to-year basis, Amazon makes itself look like a much better prospect. Analyst consensus calls Amazon a Strong Buy, while Shopify is merely a Moderate Buy. Thanks to an average price target of $137.50, Amazon stock enjoys 53% upside potential. Meanwhile, Shopify stock’s average price target of $41.11 gives it 12.63% upside potential.