E-commerce giant Amazon (AMZN) has created a new team called ZeroOne within its devices division. This group is focused on inventing brand-new consumer products and is led by J Allard, a former Microsoft executive who helped create the Xbox and Zune. The team is based in Seattle, San Francisco, and Sunnyvale, and works on both hardware and software projects. The name “ZeroOne” comes from its goal of taking ideas from nothing (zero) to launch (one).

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Amazon has had a mix of successful and failed products over the years. While it found success with devices like the Kindle, Echo, and Fire TV Stick, it also had flops such as the Fire Phone and the Halo fitness tracker. Many of these products were developed by Amazon’s hardware team, Lab126. However, ZeroOne is seen as a new push for innovation. Interestingly, Job postings are hinting at smart-home products that use computer vision, and say that the team values design thinking, rapid testing, and building new product categories. The group includes staff with experience from Alexa, Luna gaming, and the Halo sleep tracker, and is led in part by the founder of Lightform, a startup Amazon bought.

However, while Amazon grows the ZeroOne team, it has cut jobs in other parts of its devices and services division. In fact, it recently laid off about 100 employees, including people working on Alexa, Amazon Kids, and at Lab126. Over 50 of these layoffs happened at the Sunnyvale facility, according to California records. Nevertheless, it is worth noting that Amazon said the cuts only affected a small percentage of the division, which has tens of thousands of workers.

Is Amazon Stock Expected to Rise?

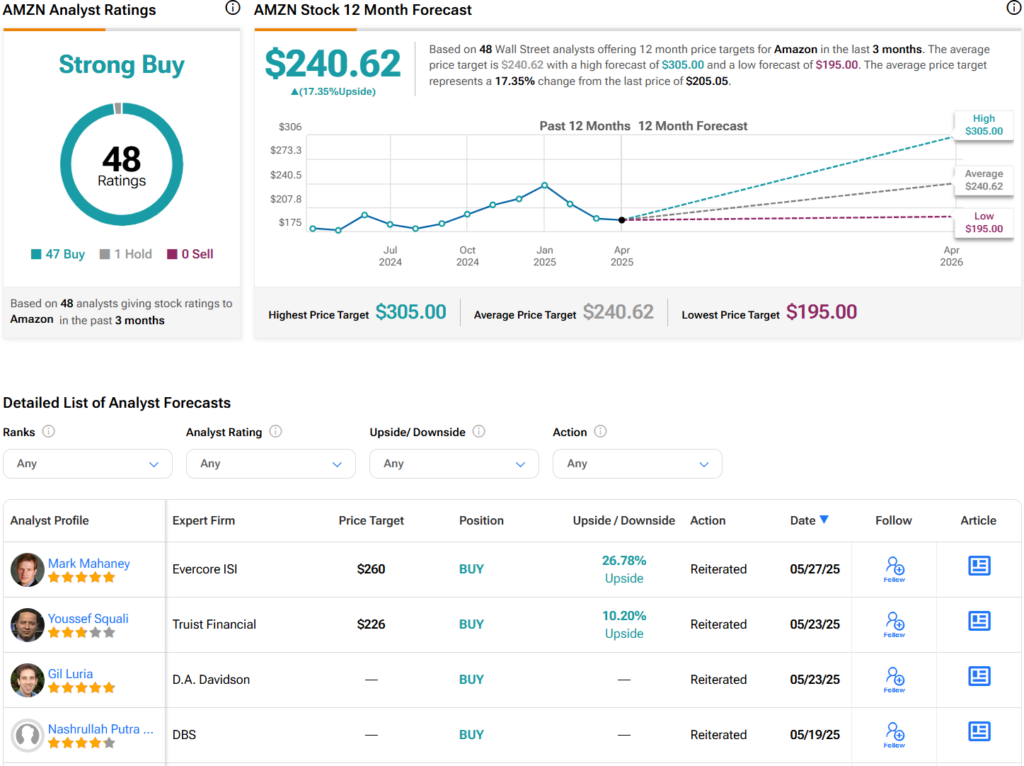

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 47 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $240.62 per share implies 17.4% upside potential.

See more AMZN stock analyst ratings

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue