Tobacco company Altria Group, Inc. (MO) announced that it has entered into an agreement to sell its Ste. Michelle Wine Estates Business to Sycamore Partners Management, L.P. for $1.2 billion. Sycamore, a private equity firm, primarily specializes in consumer, retail, and distribution investments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Following the news release, shares of the company gained 2.1% in Friday’s trading session. Further, it appreciated marginally to close at $47.47 in the extended trading session.

The transaction, which is likely to close in the second half of 2021, is not expected to be material to Altria’s earnings. Hence, the company has decided to exclude its effect from its diluted earnings per share. Notably, the company expects to use the net proceeds from the sale for additional share repurchases.

CEO of Altria Billy Gifford said, “We believe the transaction is an important step in Altria’s value creation for shareholders and allows our management team greater focus on the pursuit of our Vision to responsibly transition adult smokers to a non-combustible future.” (See Atria stock chart on TipRanks)

On July 9, Stifel Nicolaus analyst Christopher Growe reiterated a Buy rating on the stock with a price target of $56, which implies upside potential of 18.1% from current levels.

According to the analyst, the decision of Altria to sell its Ste. Michelle Wine Estates Business is a prudent one as the business has not been value accretive over the years. “With the sale, the company can now focus on its reduced nicotine risk products business, which has noteworthy growth visibility in the future,” the analyst added.

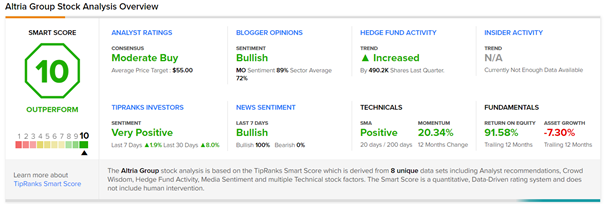

The stock has a Moderate Buy consensus rating based on 7 Buys and 3 Holds. The average Altria price target of $55 implies upside potential of 16% from current levels.

Altria scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained about 17.9% over the past year.

Related News:

Brunswick Corporation’s Freedom Acquires Spain’s Fanautic Club

Bentley Systems’ Seequent Snaps up Aarhus GeoSoftware

Cisco Concludes Acquisition of Socio Labs