Altria (NYSE:MO) is the market share leader in the U.S. tobacco industry. I’m bullish on Altria stock because of its sustainable dividend yield, overwhelming analyst pessimism, recession-resistant products, and commitment to a brighter future. However, with only three of the eight analysts covering Altria assigning it a Buy rating, I think analysts are wrong about this 9%-yielding stock, which has underperformed the market in recent years.

MO Stock’s Huge Yield Looks Sustainable

Altria has averaged $8.46 billion of free cash flow over the past three years, which covers its $6.78 billion 2023 dividends paid. The company has minimal capital needs, so it has been using its excess cash to buy back shares and reduce debt.

A transition to smokeless tobacco raises some concerns, but so far, all signs point to this being a profitable endeavor. In the beginning stages of this transition, Altria still reported a higher operating margin and higher free cash flow figure than it reported in 2021.

Also, while U.S. cigarette consumption is expected to decline, total U.S. tobacco revenue is expected to grow at a 0.62% compound annual growth rate (CAGR) through 2028, according to Statista. This is due to an increase in e-cigarette use and cigars. Altria should get its share of growth with its deeply entrenched brands and supply chain.

Lastly, as state and federal governments crack down on the sale of illicit vapor products, Altria stands to benefit. The less illicit product that is sold, the more regulated products Altria will sell. This is an underestimated tailwind for Altria.

Altria’s Financial Position Is Manageable

I think the company’s $25.11 billion of long-term debt is manageable, given its high and consistent cash flow generation. As a result, the business would probably be best served repurchasing shares and reducing its dividend obligation rather than reducing low-interest-rate debt. Altria could also improve its current ratio of 0.49 (although this is skewed by a $2.7 billion non-cash current liability).

Altria’s Products are Recession-Resistant

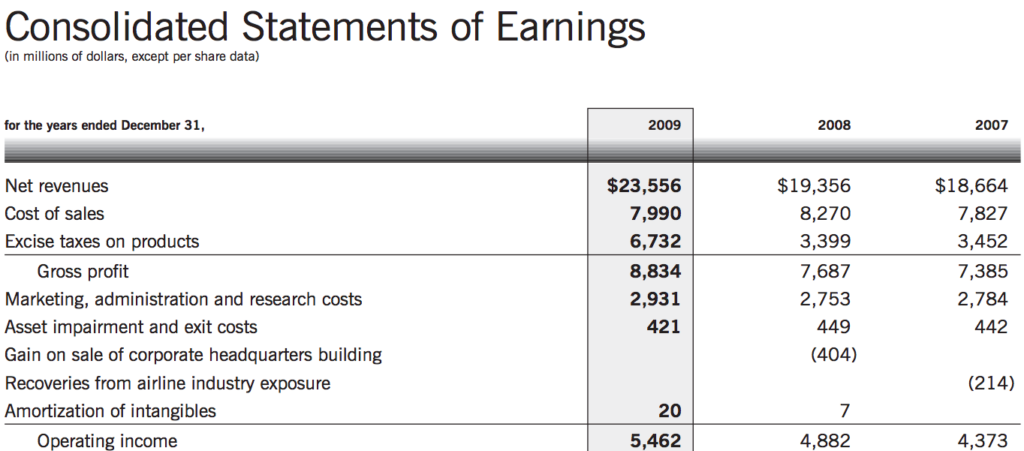

Nicotine is essential to many consumers’ daily lives, so the demand for it tends not to fall off during a recession. To Altria’s customers, Nicotine isn’t a discretionary purchase; it’s a necessity. During the Great Financial Crisis of 2008, Altria’s products were resilient. From 2007 to 2009, Altria actually grew its revenue by 26% and grew its operating income by 27%.

Have a look for yourself below (Altria’s 2009 income statement):

A Brighter Future as Combustibles Get Phased Out

Tobacco was an extremely popular substance in the 1950s and 1960s before consumers realized its negative health effects. Just watch the old tobacco commercials on YouTube, and you will understand why. I think this is comparable to alcohol today, where commercials hype up the substance. Today, alcohol is extremely popular despite its tendency to cause cancer.

Fast forward to 2024, and tobacco is an exceptionally hated product. The societal pressure to avoid tobacco is immense in many countries. Governments have imposed extensive regulations on the sale of cigarettes and have largely succeeded in educating people on the harmful effects. However, Nicotine, the substance that makes cigarettes addictive, doesn’t cause cancer. It’s the tar and chemicals formed during the combustion process that make cigarettes harmful.

The solution? Slowly phase out combustible cigarettes in favor of non-combustible nicotine products that could be less harmful. This is potentially a win-win for consumers and tobacco companies, a brighter future for all.

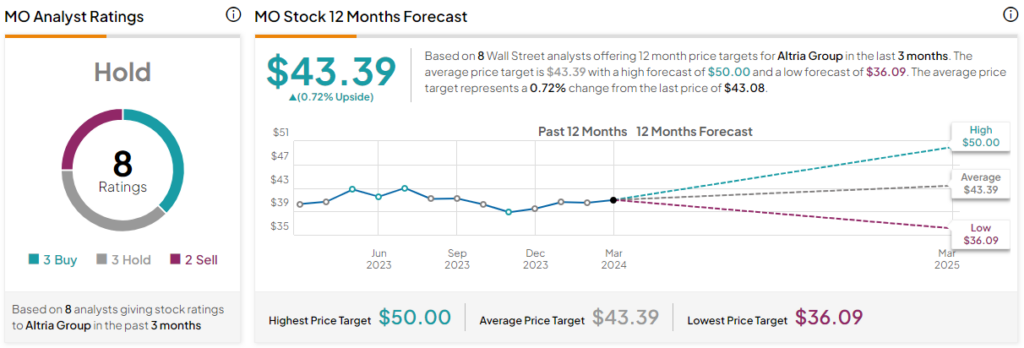

Contrarian Opportunity: Analysts Don’t Think MO Stock Is a Buy

Currently, three out of eight analysts covering MO give it a Buy rating, three rate it a Hold, and two analysts rate it a Sell, resulting in a Hold consensus rating. The average MO stock price target is $43.39, implying upside potential of just 0.7%. Analyst price targets range from a low of $36.09 per share to a high of $50 per share.

Given that Wall Street usually leans bullish, this is quite not an optimistic outlook, and I think it could be a contrarian signal, given the strong fundamentals and low valuation (shown via its high dividend yield). In my experience, when analysts upgrade a stock, the share price often surges.

The Bottom Line on MO Stock

Altria is a cheap, cash-generative business. Given that its 9% dividend is covered and that the company still has cash left over to reduce debt and repurchase shares, I think the stock is undervalued. Altria sells a recession-resistant product, which helped the company experience revenue and EBIT growth during the Great Financial Crisis.

Additionally, state and government intervention could reduce illicit vapor sales, boosting sales at Altria. Further, as societal and analyst pessimism swells, I see Altria as a contrarian opportunity.