Alphabet Inc. (GOOGL) (GOOG) is bringing its self-driving cars to London. The company said it plans to start testing its electric Jaguar iPACE cars on public roads soon, with safety drivers behind the wheel. The ride-hailing service is set to open in 2026, pending approval from regulators in the United Kingdom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Waymo’s move marks its first expansion into Europe and its second international market after Tokyo. The company already runs commercial robotaxi services in five U.S. cities, including San Francisco, Los Angeles, Phoenix, Austin, and Atlanta. It also plans to begin service in Miami and Washington, D.C., later this year.

Growth and Partnerships

In London, Waymo will work with Moove, a fleet management firm that handles maintenance and charging for ride-hailing companies. The partnership will help manage Waymo’s electric cars and local operations. Waymo’s system uses radar and lidar sensors to guide vehicles on the road, and the company says it has logged over 100 million miles without human control.

At the same time, the U.K. is speeding up its rules for self-driving vehicles. The government plans to allow pilot programs as early as spring 2026 under the new Automated Vehicles Act. Officials expect the move to attract more investment and create new jobs in the growing autonomous sector.

Competition in the Capital

Waymo will face early competition in London from Wayve, a U.K. startup backed by Microsoft (MSFT), SoftBank (SFTBY), and Nvidia (NVDA). Wayve is building a system that relies mainly on cameras instead of lidar sensors, and it plans to test its own robotaxis next year in partnership with Uber (UBER).

London’s busy traffic makes it a key testing ground for both companies. Waymo’s success there could shape how fast self-driving services spread across Europe.

Alphabet reports Waymo’s results under its “Other Bets” unit, which brought in $373 million in revenue last quarter but posted a $1.25 billion loss.

Is Google a Buy, Hold, or Sell?

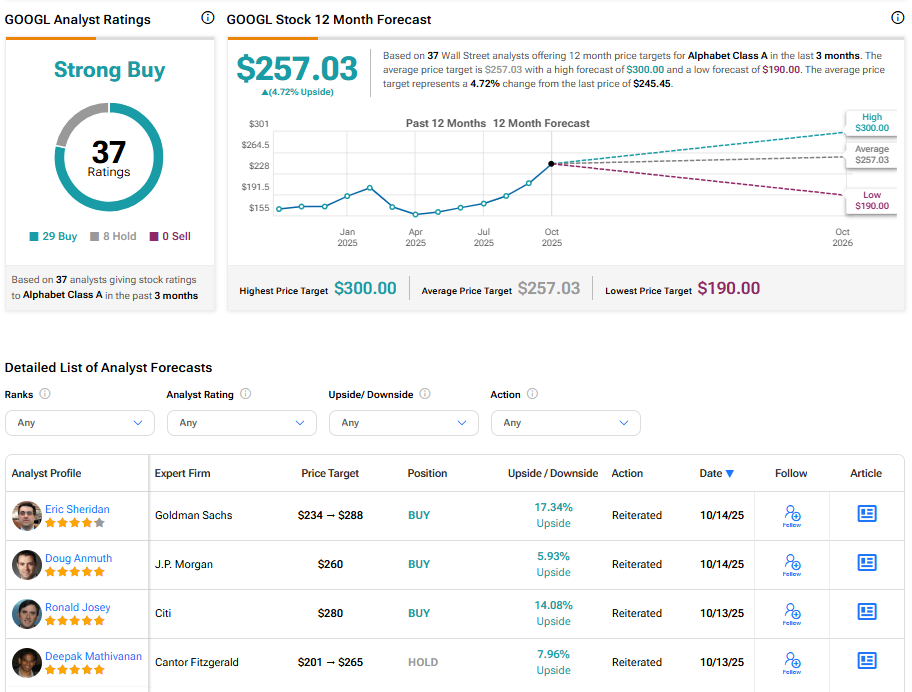

On the Street, Alphabet continues to boast a Strong Buy consensus, based on 37 analysts’ ratings. The average GOOGL stock price target stands at $257.03, implying a 4.72% upside from the current price.