Alphabet- (NASDAQ:GOOGL)(NASDAQ:GOOG) owned Google is facing an antitrust trial. The Justice Department accused Google of using restrictive agreements to uphold its market dominance in the search business and suppress competitors. Though an adverse court ruling may impact Google’s search business, it’s highly unlikely that it would lead to the end of its dominance in the search industry.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Google’s Search Dominance

As the trial proceeds, Bernstein analyst Toni Sacconaghi sees a possibility that the court may deliver an unfavorable verdict against Google. Such a ruling could lead to the termination of its agreements with prominent partners like Apple (NASDAQ:AAPL) and other entities, ultimately hurting its market share within the search industry.

For example, Alphabet’s search business benefits from increased user adoption and mobile device usage, which gets a boost from these agreements. Thus, the absence of its contracts with Apple and other partners may adversely affect its use and, consequently, affect its financial performance. Nonetheless, Google’s search business thrives on its exceptional quality, continuous innovation, and leadership in AI (artificial intelligence). This indicates that its competitors may find it hard to erode its market share.

Investors should note that Alphabet’s Google dominates the Search market, holding the majority share. On October 3, Bank of America Securities analyst Justin Post increased Alphabet’s price target, citing Google’s search dominance. Highlighting data from StatCounter, a web traffic analysis website, Post said that Google holds 91.6% of the Search market. In comparison, Microsoft’s (NASDAQ:MSFT) Bing has a 3% share. However, both companies witnessed a slight decline in market share in September 2023.

With this backdrop, let’s look at the Street’s projection for Alphabet stock.

Is Alphabet a Buy or Sell Stock?

Wall Street analysts are unfazed by the ongoing antitrust trial against Google. While the trial’s outcome is uncertain, analysts expect the company to benefit from its strength in the Search business, recovery in ad revenues, growth in the Cloud segment, and AI-driven new offerings.

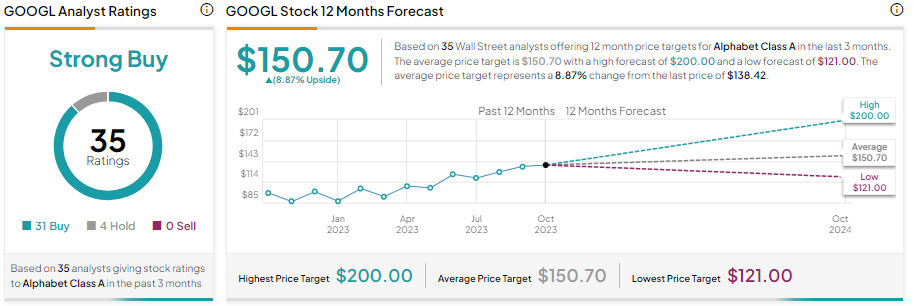

GOOGL stock has received 31 Buy and four Hold recommendations for a Strong Buy consensus rating. However, given the year-to-date growth of 56.5% in its price, analysts’ average price target of $150.70 implies a limited upside potential of 8.87% from the current levels.