Alphabet’s (NASDAQ:GOOGL) Google is aiming to revamp its ad sales unit, The Information reported. According to the report, the tech giant is contemplating a major restructuring of its ad sales team, which currently consists of 30,000 employees. This has sparked concerns about potential job reductions in a few departments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Google’s restructuring strategy aligns with its goal of utilizing AI (Artificial Intelligence)-driven advertising solutions to entice advertisers. The company is increasingly embracing AI and machine learning to elevate customer engagement with ads on its various platforms. The report also highlighted that these AI-driven advertising solutions are expected to generate multi-billion-dollar annual revenue for the company.

While it remains to be seen whether Google announces job cuts in its ad sales unit, the company removed 12,000 employees in January 2023. Like its peers, Google focuses on improving margins, deploying AI to improve efficiency, and accelerating growth.

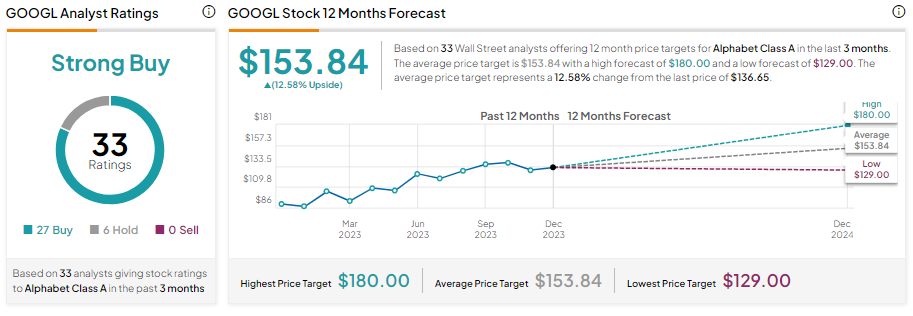

With this background, let’s look at what the Wall Street analysts recommend for GOOGL stock.

Is Alphabet a Buy, Hold, or Sell?

Alphabet’s investments in AI, dominance in the search business, and growing ad revenues are positives that keep analysts bullish about its prospects. GOOGL stock has received 27 Buys and six Holds for a Strong Buy consensus rating. The analysts’ average price target of $153.84 implies 12.58% upside potential from current levels.