Tech behemoth Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) Google unit is rolling out its generative artificial intelligence (AI) software, Gemini, to select corporates. As per a report from The Information, Google is giving out a relatively larger version of Gemini to developers but it is withholding the largest version for the time being.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gemini is based on the large language models (LLMs) software that feeds on the vast data available on the internet. The tool can power advanced technology such as chatbots, drafts, music lyrics, news stories, and more. Plus, the Gemini software can help write codes and produce images or text based on the user’s requirements.

Gemini is Google’s answer to Microsoft (NASDAQ:MSFT) and the OpenAI-partnered ChatGPT 4 model. Once Google is fully satisfied with the performance of Gemini, it will commercially roll out the final version through its Google Cloud Vertex AI service.

Technology companies are competing fiercely to capture a larger portion of the AI market while trying to onboard as many enterprise clients as possible. Last month, Google unveiled a series of AI-powered features across its portfolio of products, including Workspace Collaboration, Infrastructure, Data and AI, and Cybersecurity solutions. What stood out was the pricing ($30 per month per user) of its AI tools for businesses, which matched Microsoft’s offerings for enterprises.

Is Google a Safe Long-Term Stock?

Wall Street is highly optimistic about Google’s stock trajectory, although the company is facing its own string of challenges. Google is currently undergoing one of the most high-profile anti-monopoly cases, with the Justice Department (DOJ) alleging bribery for search dominance. Further, Google recently announced laying off hundreds of roles from the global recruiting team as the company tries to streamline operations.

Even so, with 31 Buys versus four Hold ratings, GOOGL stock commands a Strong Buy consensus rating. On TipRanks, the average Alphabet Class A price target of $150.67 implies 9.1% upside potential from current levels. Meanwhile, GOOGL stock has gained 54.9% so far this year.

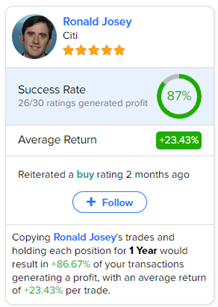

Moreover, investors looking for the most accurate analyst for GOOGL could follow Ronald Josey from Citi. Copying his trades on this stock and holding each position for one year could result in 87% of your transactions generating a profit, with an average return of 23.43% per trade.