Tech giant Alphabet’s (NASDAQ:GOOGL)(NASDAQ:GOOG) Google is undergoing one of the biggest antitrust trials in American history. The U.S. Justice Department (DOJ) has alleged that Google shells out over $10 billion annually for deals to ensure its internet search dominance. The bounty helps companies retain Google as the default search engine browser on mobile phones and computers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per a Financial Times report, the case hearing began yesterday and is slated to go on for roughly 10 weeks. The opening remarks from both parties were heard by the U.S. District Judge Amit Mehta. The plaintiff’s lawyer cited the case as an important element for “the future of the internet and whether Google’s search engine will ever face meaningful competition.” The lawyer also noted that currently, Google represents 89% of the internet search market.

Details from the Trial

Google is said to be paying billions to phone manufacturers like Apple (NASDAQ:AAPL) and Samsung Electronics (GB:SMSN), wireless carriers such as AT&T (NYSE:T) and Verizon (NYSE:VZ), and browser developers like Mozilla and Opera to secure default status for its general search engine, thus hindering competition. Google is also alleged to reject the proposed changes made by Apple, threatening to scrap the ad deal.

Meanwhile, the lawyer for Google stated that it does face stringent competition in the search market. He also alleged that the plaintiff’s complaints seek to hamper competition in the space by allowing inferior products to dominate in the short run, hoping that it will be beneficial in the long run. Google has always maintained that its dominance in the search market is based purely on superior quality offerings and customer loyalty.

The DOJ’s antitrust unit is targeting the monopolistic nature of big tech enterprises. The regulators are also accusing Google of conducting monopolistic practices in the ad business. Further, they claim that the company has been deleting/hiding documents that are crucial to the case. As per the report, most of the DOJ’s witnesses include current and former employees of Google and senior staff from counterparties with which it has deals.

Is Google Stock a Good Buy Right Now?

Following the first day of the case hearing, Barclays analyst Ross Sandler reiterated a Buy rating on GOOGL stock with a price target of $200 (47.8% upside potential). Sandler noted that the case has billions of dollars in profit at stake for both Google and Apple.

The outcome of the case will decide whether Google can continue paying Apple the roughly $20 billion in traffic acquisition costs (TAC). Even so, the analyst maintained that the fate of the case would only be known at the very end of the trial. No speculation can define the result of one of the largest antimonopoly cases in the history of the U.S.

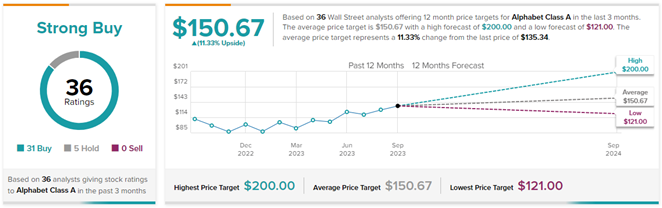

With 31 Buys and five Holds, Alphabet stock commands a Strong Buy consensus rating. On TipRanks, the average Alphabet Class A price target of $150.67 implies 11.3% upside potential from current levels. Meanwhile, GOOGL stock has gained 51.9% year-to-date.