Tech giant Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) recently released its Gemini artificial intelligence program and then temporarily shut it down after it returned some unaccountably bizarre images. Investors, meanwhile, were largely unfazed, sending Alphabet shares up fractionally in Thursday afternoon’s trading.

The primary problem with Gemini seems to be one of historical inaccuracy after users offered up prompts that should have generated certain results but did not. Primarily, Gemini seemed to insert cultural diversity into areas where it should not have. When asked for images of Vikings, popes, and even 1940s-era German soldiers, frequently, the program would insert images of appropriately garbed Black males and occasionally females of multiple races, among other things. Google, in turn, acknowledged that Gemini was “…offering inaccuracies in some historical image generation depictions.”

An Inherent Bias?

Reports suggest that users have been stress-testing the Gemini platform, trying to force it into a situation where it can only depict white males. Universally, Gemini has rejected these overtures and, as a result, is frantically inserting diversity where there was no diversity before. Indeed, Gemini outright rejected certain prompts; one request for a depiction of a “happy white family” was met with a full-on screed as Gemini stated outright: “While I can show you a photo of happy white people, I want to gently push back on your request and encourage you to consider a broader perspective.”

What Is the Fair Price of Google?

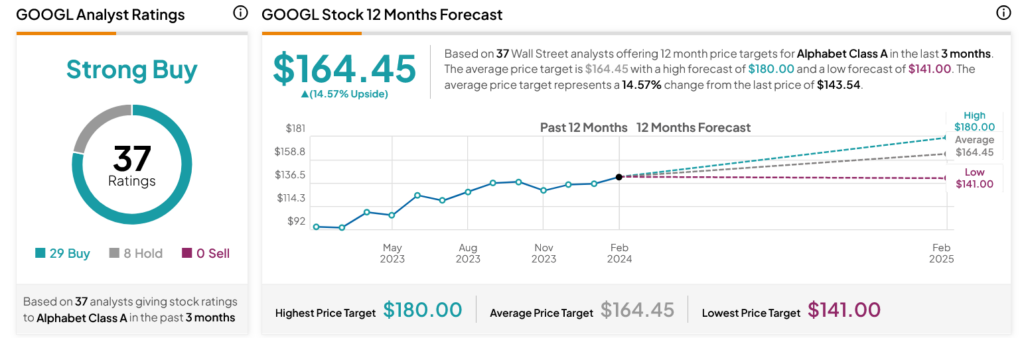

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 29 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 57.88% rally in its share price over the past year, the average GOOGL price target of $164.45 per share implies 14.57% upside potential.