The stock of medical device company Align Technology (NASDAQ:ALGN) soared 15% in yesterday’s trading session after the release of better-than-expected fourth-quarter results. The quarterly results reflect benefits from higher clear aligner (or invisible braces) shipments, partially offset by forex headwinds.

Revenue decreased 12.6% year-over-year to $901.5 million, beating the consensus estimate of $891.8 million. During the quarter, Clear Aligner revenue was $731.7 million (down 10.3%), and Imaging Systems and CAD/CAM Services revenue was $169.9 million, down 21.3% year-over-year.

Adjusted EPS of $1.73 exceeded expectations of $1.54. The figure, however, compares unfavorably with the $2.83 reported in the last year’s quarter.

For the full year 2022, Align reported revenue of $3.7 billion, down 5.5% year-over-year. Also, adjusted earnings decreased by 30.8% to $7.76 per share.

Along with earnings, the company announced a new $1 billion repurchase program to succeed the existing program. Align plans to complete the current $1 billion buyback program by repurchasing the remaining $250 million in Q1 2023.

Outlook for Q1

Regarding the outlook, the company expects total revenue in the first quarter of 2023 to remain flat sequentially. Meanwhile, clear aligner volumes are anticipated to decline from the previous quarter due to weakness in China from COVID.

Is Align Technology a Buy?

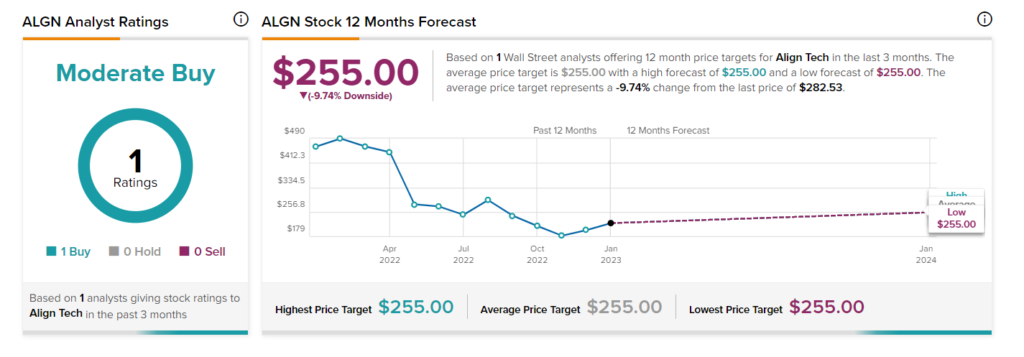

The stock has a Moderate Buy consensus rating based on one analyst rating. The average ALGN stock price forecast is $255, implying a downside potential of 9.7% at current levels.