Coming as a surprise, Alibaba Group (NYSE:BABA) co-founder Jack Ma attended the company’s co-organized event, the Global Mathematics Competition, on Saturday, June 17. This marks as one of the few appearances by the billionaire after he stopped appearing publicly, post criticizing the Chinese regulators in 2020.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the event held by its in-house research arm, Ma spoke about the “understanding of mathematics” with participants in the competition that he had initiated five years ago. He has been returning to China more frequently after undertaking multiple professorships at global universities.

In a similar series of events, Alibaba announced the company’s reorganization into six separate units in March, after Jack Ma made a sudden appearance at a Hangzhou school he founded.

Alibaba Stock Cheers European Expansion

At the recent Viva Tech Conference in Paris, Alibaba president Michael Evans noted the company’s move into Europe as a strategic shift for international e-commerce operations. The company said that it will expand its Tmall eCommerce site to Europe with an initial pilot project in Spain before further expanding to the rest of Europe.

While Tmall will focus on selling local brands to local shoppers, AliExpress ships goods from China into Europe. AliExpress is yet another step by the Chinese giant in its overseas expansion strategy.

In the past 3 months, the stock has gained 13.7% with the past five-day gains at 4% after the company announced its European expansion.

Morgan Stanley Top Asia Pick

In a recent list of Morgan Stanley’s Top Asia Picks, Alibaba is one of the top five picks, in the China internet sector. It is forecasted to generate more than 50% returns in the upcoming 12 months. The bank is optimistic about Asian stocks as the MSCI Asia Pacific Equities Index has risen 25% from the lows it slumped to in October 2022.

Notably, Alibaba’s Taobao & Tmall Business Group disclosed a record number of merchants’ participation in China’s mid-year shopping festival, “6.18,” through its online marketplaces. Wherein, the daily average number of people watching short videos marked a 113% year-over-year surge while the number of influencers and Taobao merchants releasing short-form videos daily saw a 200% and 55% growth respectively.

Is Alibaba a Good Stock to Buy?

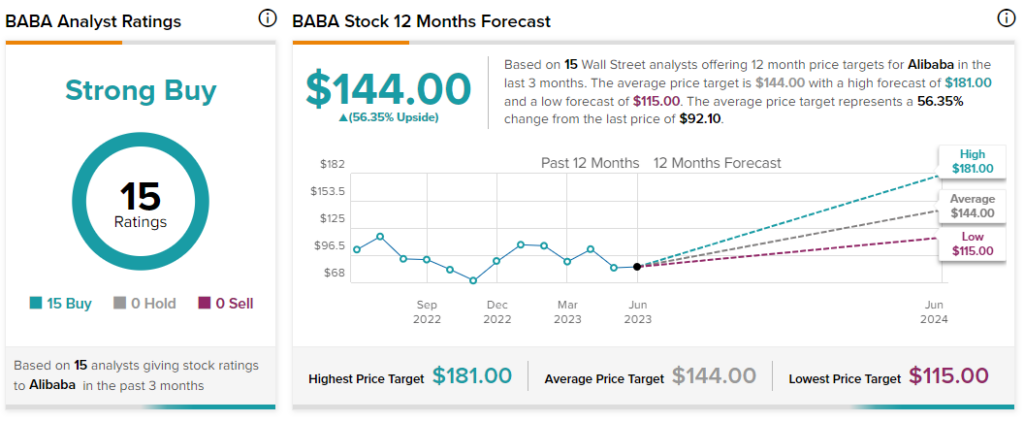

All the 15 Wall Street Analysts covering the stock rate it a Buy, taking the average analyst consensus rating to Strong Buy with analysts’ 12-month average price target of $144, implying a 56.4% upside potential.

Two weeks ago, Jefferies Analyst Thomas Chong reaffirmed his Buy rating on the stock with a $181 price target, implying a 96.5% upside potential.