The e-commerce heavyweight Alibaba Group (NYSE:BABA) has set its sights on Europe as it expands its presence beyond its home turf of China, according to Reuters. In an announcement by J. Michael Evans, the company’s president, he revealed their ambition to foster local businesses and online platforms, bringing their successful TMall model to European markets. “The future is about building local businesses, translating our TMall model from China to Europe. It’s about serving local brands and catering to local customers in their own markets,” Evans expressed during a tech conference in Paris. This venture has already started rolling out with a pilot project in Spain, with plans for expansion across Europe in the pipeline. BABA shares are trading higher at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Evans also addressed inquiries about Alibaba’s founder, Jack Ma, who stepped out of the limelight after voicing criticism against China’s regulatory system in 2020. He assured everyone that Ma, still the company’s largest shareholder, is not only well but deeply invested in the company. “Jack Ma’s commitment to Alibaba is as robust today as it was at the company’s inception, and we anticipate this to remain constant,” Evans emphasized.

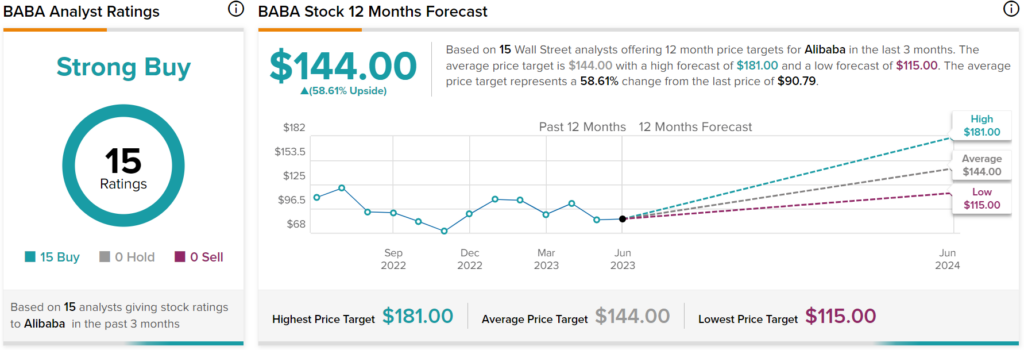

Turning to Wall Street, analysts have a Strong Buy consensus rating on BABA stock based on 15 Buys assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $144 per share implies 58.61% upside potential.