Albemarle Corp. (NYSE: ALB) has reported solid first-quarter 2022 results on the back of strong demand for its products. Shares of the specialty chemicals manufacturing company gained 15.1% in Wednesday’s extended trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adjusted earnings came in at $2.38 per share, which more than doubled from $1.10 per share in the last year’s quarter. Also, the figure easily surpassed the consensus estimate of $1.63 per share.

Revenues increased 36% year-over-year to $1.13 billion, outpacing estimates of $1.02 billion. The upside can be primarily attributed to 97.2% and 28.2% growth in the sales of Lithium and Bromine, respectively.

Adjusted EBITDA of $432 million increased 88% from the same quarter last year on the back of higher net sales.

The CEO of Albemarle, Kent Masters, said, “Many of the end markets we serve are critical for transitioning to greener energy and advancing electrification and digitalization. Our ongoing investments capitalize on the rapid growth and strong pricing trends in these markets. We continue to explore sustainable options to expand our conversion capacity and resources, including opportunities in North America and Europe.”

Outlook

Albemarle has raised full-year 2022 net sales guidance between $5.2 billion and $5.6 billion, up from $4.2 billion and $4.5 billion guided previously.

Also, the company now expects adjusted EBITDA to be between $1.7 billion and $2 billion, compared with the previous guidance of $1.15 billion to $1.3 billion.

Albemarle anticipates adjusted EPS in the range of $9.25-$12.25, up from the previously provided guidance of $5.65-$6.65.

Stock Rating

Based on eight Buys, five Holds and one Sell, the stock has a Moderate Buy consensus rating. Albemarle’s average price forecast of $249.23 implies 15.7% upside potential from current levels. Shares have gained 29.9% over the past year.

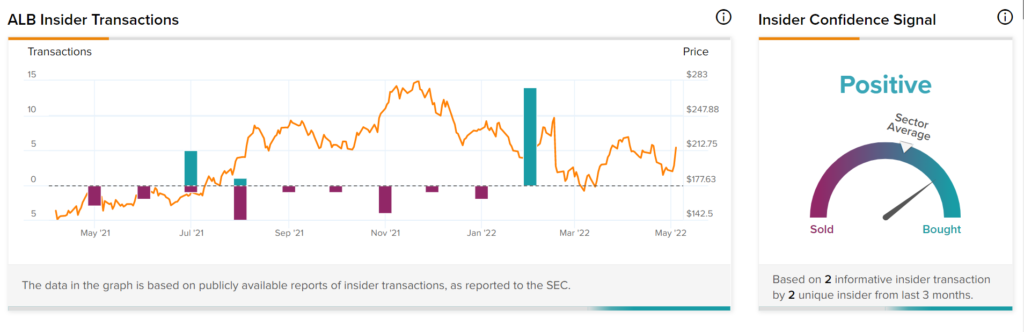

Insider Trading

According to Tipranks, Corporate insider sentiments are Positive on Albemarle. This means that over the past quarter there has been an increase in insiders buying their shares of ALB.

Final Thoughts

Albemarle has performed well in the recently reported quarter. Also, the company is likely to keep benefitting from higher pricing and upbeat demand for its products. Investors interested in ALB may take a closer look at the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Is Pfizer Stock worth Considering Post Upbeat Q1 Results?

Esperion Therapeutics Rises on Upbeat Q1 Results

Akamai Technologies Lose Sheen after Posting Mixed Q1 Results