Shares of Pfizer Inc. (PFE) rose 2% on Tuesday after its reported stellar results for the first quarter of 2022. The company develops, manufactures and sells healthcare products, including innovative medicines and vaccines.

Results in Detail

Pfizer has reported adjusted earnings of $1.62 per share, up 72% year-over-year, beating analysts’ estimates of $1.47 per share.

Quarterly revenues grew 77% year-over-year to $25.7 billion and surpassed analysts’ estimates of $23.9 billion.

In the quarter, revenues from Comirnaty (Pfizer-BioNTech SE COVID-19 vaccine) and Paxlovid stood at $13.2 billion and $1.5 billion, respectively.

The Chairman and CEO of Pfizer, Dr. Albert Bourla, said, “We continue to supply the world with Comirnaty, which remains a critical tool for helping patients and societies avoid the worst impacts of the COVID-19 pandemic, and we are on track to fulfill our commitment to deliver at least 2 billion doses to low- and middle-income countries in 2021 and 2022, including at least 1 billion doses this year.”

FY22 Outlook

Pfizer has lowered its adjusted EPS guidance for 2022. The company expects it to be in the range of $6.25 to $6.45, compared with the prior guidance of $6.35 to $6.55. The consensus estimate for the same is pegged at $7.14 per share.

Revenues outlook remains unchanged. It is projected to be between $98 billion and $102 billion, lower than the consensus estimate of $105.9 billion. The guidance range reflects 27% operational growth from 2021 revenues at the midpoint.

The revenue guidance includes $32 billion from the sales of Comirnaty and $22 billion from Paxlovid sales.

Analyst’s View

Following the release, Mizuho Securities analyst Vamil Divan reiterated a Hold rating on the stock with a $55 price target, which implies 11.6% upside potential.

The analyst stated, “We continue to expect many more transactions from Pfizer over the next couple of years as management works to boost their pipeline and product portfolio. We also believe a larger, more synergy-driven deal remains possible in the 2023/2024 timeframe, before the company starts facing large patent expirations in the second half of this decade.”

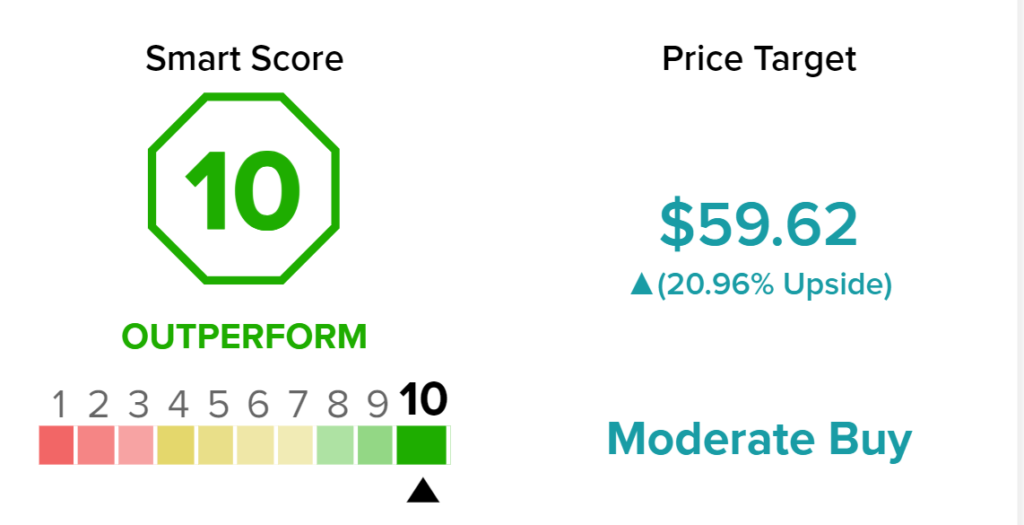

With six Buys and eight Holds, the stock has a Moderate Buy consensus rating. Pfizer’s average price target of $59.62 implies 21% upside potential to current levels.

Smart Score

According to TipRanks’ Smart Score rating system, Pfizer scores a “Perfect 10,” indicating that the stock has strong potential to outperform market expectations. Bloggers are bullish and Investor Sentiment is Very Positive on the stock. Meanwhile, Hedge Funds have increased their holdings of PFE stock by 8.8 million shares, and Insiders have bought $9.6 million worth of shares in the last quarter.

Takeaway

Pfizer continues to reap benefits from the pandemic-related vaccines and is making efforts to bolster its non-COVID portfolio. Further, the confidence of hedge funds and insiders is likely to help boost the stock’s performance.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

What Pulled Chegg Stock Down 32% on Monday?

Onsemi Stock Rallies on Upbeat Q1 Results

Avis Budget Drives to Strong Q1 Results