This is a terrible time of year for anything to go wrong with an airline stock. Alaska Air (NYSE:ALK) just found out as much as contract negotiations are carrying on with the Association of Flight Attendants-CWA union. Yet, despite this, and despite an “informational picket” already in progress, investors aren’t disheartened, sending Alaska Air shares up over 2% in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Alaska Air flight attendants are currently engaged in said informational picket, while contract negotiations are carrying on in the background. A new merger between Alaska Air and Hawaiian Holdings (NASDAQ:HA) is causing deep concern, and the union is gathering information accordingly. The duo previously noted that, should the merger go through, all currently-established bases would remain open, and there will even be contract-based protections put in place to ensure those assignments carry on as well. However, the union noted that the previous proposals from Alaska Air have not been “…economically feasible” so far.

Pickets Slated to Spread

While it’s not a full strike, at least not yet, it’s not doing Alaska Air any favors. Worse, reports note that the current picketing—mostly at Seattle-Tacoma International Airport—is set to expand. Already, picketing is slated to move to Portland International Airport, and “multiple airports nationwide” will also find themselves host to such pickets. Though there aren’t any flight disruptions expected as a result—this isn’t a full strike, after all—Alaska Air is still letting customers know. With the holiday travel season still in effect for basically another week or two, any disruption could be disastrous. Just ask the airlines impacted last year by the “Christmas Eve blizzard,” as it was called.

Is Alaska Airlines a Good Stock to Buy?

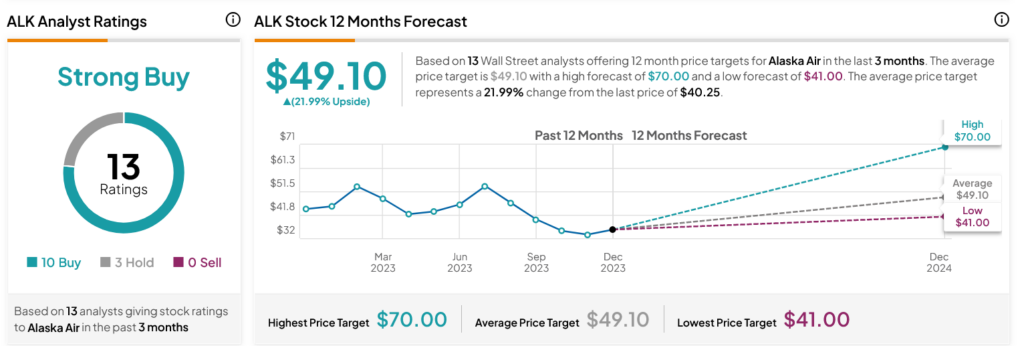

Turning to Wall Street, analysts have a Strong Buy consensus rating on ALK stock based on 10 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 6.57% loss in its share price over the past year, the average ALK price target of $49.10 per share implies 21.99% upside potential.