Akoustis Technologies reported a lower-than-expected loss of $0.19 per share, versus analysts’ loss expectations of $0.20 a share. However, it was wider than the year-ago loss per share of $0.16. Its revenues of $366,000 missed analysts’ expectations of $716,670 and remained flat from the year-ago quarter.

Akoustis (AKTS), which makes radio frequency (RF) filter products for the mobile wireless device industry in the US, posted a 350% increase in core filter product revenue in 4Q. The company’s CEO Jeff Shealy said that “we began shipping RF filter products into our first two high-volume commercial markets, namely 5G small cell network infrastructure and WiFi CPE devices, at the end of the quarter.”

Despite the COVID-19 challenges, the company’s interim CFO Ken Boller expects “revenue growth of at least 50% sequentially in the September quarter, driven by the commencement of production in the 5G small cell market and a continued ramp of our ultra-high frequency of 5.2 and 5.6 gigahertz WiFi filters.” (See AKTS stock analysis on TipRanks).

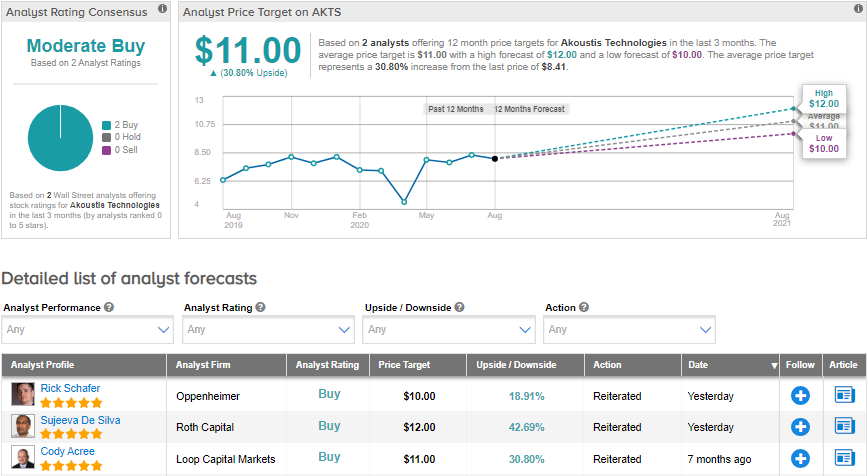

Following the 4Q results, Roth Capital analyst Sujeeva De Silva raised the stock’s price target to $12 (42.7% upside potential) from $10 and maintained a Buy rating. He believes that the company is an emerging vendor of RF filters. Further, he expects several customers to commence volume production that would consistently drive revenue growth throughout FY21.

Currently, the Street has a Moderate Buy analyst consensus on the stock. The average price target of $11 implies upside potential of about 31%, with shares up over 5% on a year-to-date basis.

Related News:

Palo Alto Beats 4Q Estimates Spurred By Remote Working Trend

Apple at Current Levels Remains a Strong Buy, Says 5-Star Analyst

Qiagen To Roll Out Rapid Antibody Covid-19 Test In US As Citigroup Turns Bullish