Shares of Airbnb (ABNB) gained about 5% during Tuesday’s extended trading session, after the company posted robust first-quarter numbers on the back of a rebound in travel.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue rose 70% year-over-year to $1.5 billion, comfortably beating analysts’ expectations of $1.45 billion. The uptick in top-line coupled with cost management also helped the company narrow its net loss per share to $0.03 from a net loss per share of $1.95 a year ago. In comparison, analysts had forecast a net loss per share of $0.28.

Q1 Performance

Impressively, a combination of a higher number of nights and experiences booked and higher average daily rates (ADR) resulted in a Gross Booking Value of $17.2 billion. This was a 67% increase over the year-ago period.

This growth came to varying degrees from different geographies due to factors including COVID-19 variants, vaccination rates, travel restrictions, and cross-border versus domestic travel dependence.

The volume of nights and experiences booked in North America, EMEA (Europe, Middle East, and Africa), and Latin America remained higher than 2019 levels. In Asia Pacific, on the other hand, the volume of nights and experiences booked remained lower than 2019 levels as the region is more reliant on cross-border travel.

What Did TipRanks Website Traffic Data Indicate?

Let us find out if the TipRanks Website traffic tool could have helped investors gauge this Q1 outperformance in advance.

Data indicates total traffic to Airbnb websites across devices jumped from 63.98 million at the end of December 2021 to 101.33 million at the end of March. Further, on a quarterly basis, total website traffic jumped 44.6% as compared to the fourth quarter.

Management Weighs In

Commenting on the Airbnb 2022 summer release scheduled for May 11, the Co-Founder and CEO of Airbnb, Brian Chesky, said, “This is a new Airbnb for a new world of travel. With a completely new way to search, guests will be able to discover millions of unique homes in Airbnb they never thought to search for and when they book, guests will have the confidence knowing that Airbnb has their back each step of the way.”

Outlook 2022

Buoyed by this performance, Airbnb is expecting a strong summer travel season and sees revenue landing between $2.03 billion and $2.13 billion. Additionally, the company expects to deliver a low double-digit earnings before interest, taxes, depreciation, and amortization (EBITDA) margin percentage improvement as compared to the year-ago period.

Analyst’s Take

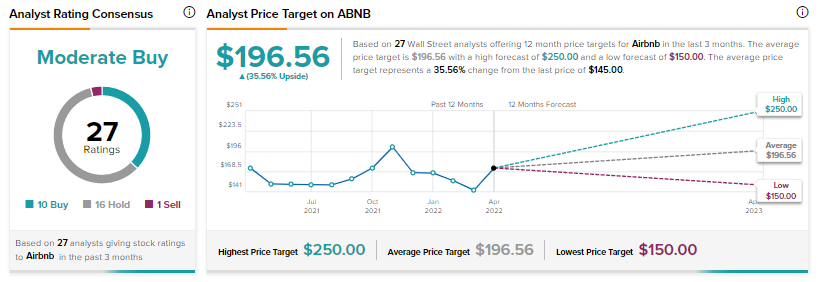

Yesterday, KeyBanc analyst Justin Patterson reiterated a Buy rating on the stock but decreased the price target to $195 from $210. The analyst believes supply expansion and changes in consumer preference can drive long-term margins and free cash flow for the company.

Overall, the Street is cautiously optimistic about Airbnb with a Moderate Buy consensus rating based on 10 Buys, 16 Holds, and a Sell. At the time of writing, the average Airbnb price target was $196.56, which implies a potential upside of 35.6%. That’s after the nearly 16% correction in the stock so far this year.

Closing Note

Airbnb has been able to capitalize on improving travel trends this quarter. Further, this performance comes despite rising inflation, rate hikes, geo-political tensions, and regional COVID-19 induced lockdowns.

As the travel industry recovers further, Airbnb may stand to gain even more. Additionally, the summer release on May 11 will be a key event to keep an eye on.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Onsemi Stock Rallies on Upbeat Q1 Results

Avis Budget Drives to Strong Q1 Results

Spirit Airlines Flies High with Frontier, JetBlue Deal Nosedives