Artificial intelligence is now part of the toolkit for hackers. They can use AI prompts to write code, scan for weak spots, and launch attacks at a pace that security teams struggle to match. On this matter, Wiz Chief Technologist Ami Luttwak warned that attackers are turning AI into a “mind game,” using simple commands to make systems reveal secrets or delete files. “Attackers are now using AI prompts as weapons,” Luttwak said, pointing out that hackers can instruct systems to “reveal secrets, wipe machines, or erase files.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These risks have already shown up in real breaches. In August 2025, hackers broke into Drift, an AI chatbot startup, and used stolen tokens to pull Salesforce (CRM) data from clients that included Cloudflare (NET) and Alphabet (GOOGL) (GOOG). The hackers leaned on AI-assisted “vibe coding,” which lets people write software by describing what they want in plain words.

At the same time, the s1ngularity attack placed harmful code in the Nx JavaScript build system and spread to developer machines. It pulled credentials and even focused on AI platforms such as Claude and Gemini.

Industry and Investor Outlook

The security flaws are not rare. A recent study from Veracode found that 45% of AI-generated code contains weaknesses. As more companies use AI to speed up work, attackers can take advantage of shortcuts.

Firms are now racing to defend themselves. Wiz, which Google bought for $32 billion, has rolled out new tools called Wiz Code and Wiz Defend. The aim is to make software development safer and to protect live systems from attack. Cybercrime is already projected to cost $10.5 trillion each year in 2025, and AI is speeding that growth. For investors, the takeaway is that demand for stronger defense tools will rise. Companies that can deliver protection at scale may see more interest as the role of AI in both attack and defense continues to expand.

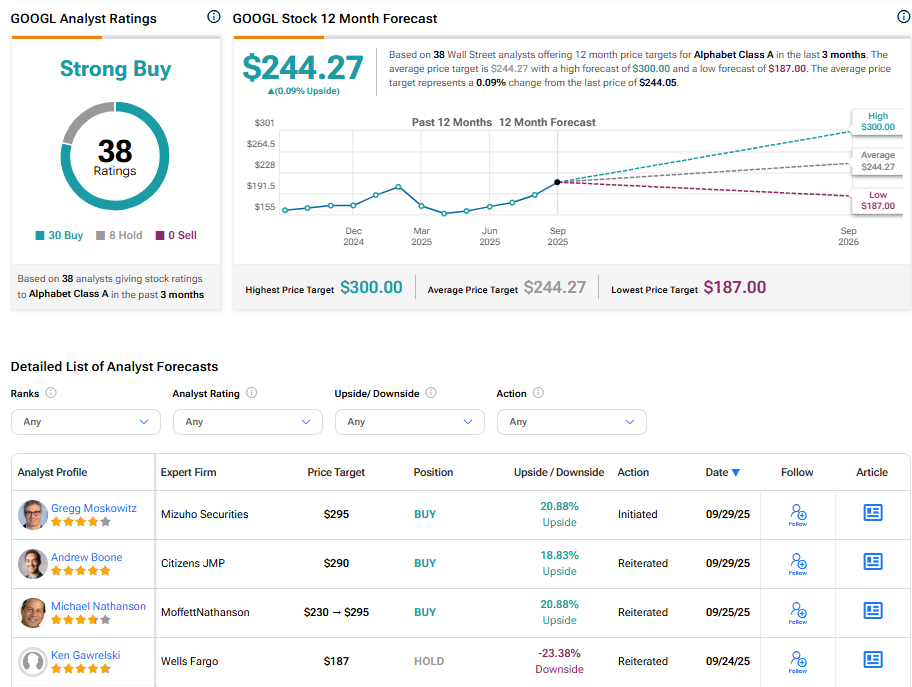

Is GOOGL Stock a Buy?

Following Google’s recent acquisition of Wiz, we can turn to Wall Street analysts for their view on the stock. Alphabet holds a Strong Buy consensus rating, with an average GOOGL stock price target of $244.27. This implies a modest 0.09% upside from the current level.